That is an opinion editorial by Federico Tenga, a very long time contributor to Bitcoin tasks with expertise as start-up founder, advisor and educator.

The time period “good contracts” predates the invention of the blockchain and Bitcoin itself. Its first point out is in a 1994 article by Nick Szabo, who outlined good contracts as a “computerized transaction protocol that executes the phrases of a contract.” Whereas by this definition Bitcoin, due to its scripting language, supported good contracts from the very first block, the time period was popularized solely later by Ethereum promoters, who twisted the unique definition as “code that’s redundantly executed by all nodes in a worldwide consensus community”

Whereas delegating code execution to a worldwide consensus community has benefits (e.g. it’s simple to deploy unowed contracts, such because the popularly automated market makers), this design has one main flaw: lack of scalability (and privateness). If each node in a community should redundantly run the identical code, the quantity of code that may truly be executed with out excessively rising the price of working a node (and thus preserving decentralization) stays scarce, which means that solely a small variety of contracts could be executed.

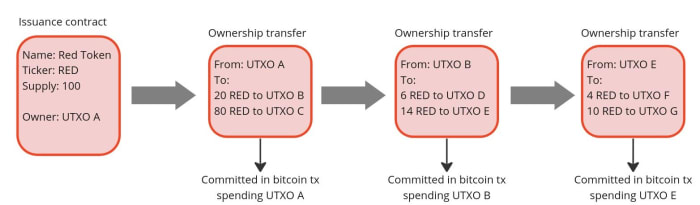

However what if we may design a system the place the phrases of the contract are executed and validated solely by the events concerned, slightly than by all members of the community? Allow us to think about the instance of an organization that desires to subject shares. As an alternative of publishing the issuance contract publicly on a worldwide ledger and utilizing that ledger to trace all future transfers of possession, it may merely subject the shares privately and cross to the patrons the proper to additional switch them. Then, the proper to switch possession could be handed on to every new proprietor as if it had been an modification to the unique issuance contract. On this means, every proprietor can independently confirm that the shares she or he obtained are real by studying the unique contract and validating that each one the historical past of amendments that moved the shares conform to the principles set forth within the authentic contract.

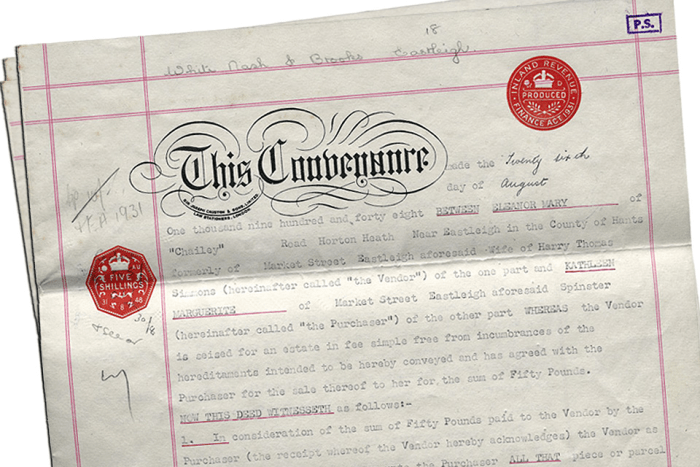

That is truly nothing new, it’s certainly the identical mechanism that was used to switch property earlier than public registers grew to become fashionable. Within the U.Okay., for instance, it was not obligatory to register a property when its possession was transferred till the ‘90s. Which means nonetheless as we speak over 15% of land in England and Wales is unregistered. In case you are shopping for an unregistered property, as a substitute of checking on a registry if the vendor is the true proprietor, you would need to confirm an unbroken chain of possession going again not less than 15 years (a interval thought of lengthy sufficient to imagine that the vendor has ample title to the property). In doing so, you could be certain that any switch of possession has been carried out accurately and that any mortgages used for earlier transactions have been paid off in full. This mannequin has the benefit of improved privateness over possession, and also you do not need to depend on the maintainer of the general public land register. However, it makes the verification of the vendor’s possession far more difficult for the client.

Supply: Title deed of unregistered actual property propriety

How can the switch of unregistered properties be improved? To start with, by making it a digitized course of. If there may be code that may be run by a pc to confirm that each one the historical past of possession transfers is in compliance with the unique contract guidelines, shopping for and promoting turns into a lot quicker and cheaper.

Secondly, to keep away from the danger of the vendor double-spending their asset, a system of proof of publication have to be applied. For instance, we may implement a rule that each switch of possession have to be dedicated on a predefined spot of a well known newspaper (e.g. put the hash of the switch of possession within the upper-right nook of the primary web page of the New York Instances). Since you can’t place the hash of a switch in the identical place twice, this prevents double-spending makes an attempt. Nevertheless, utilizing a well-known newspaper for this goal has some disadvantages:

- You need to purchase lots of newspapers for the verification course of. Not very sensible.

- Every contract wants its personal house within the newspaper. Not very scalable.

- The newspaper editor can simply censor or, even worse, simulate double-spending by placing a random hash in your slot, making any potential purchaser of your asset suppose it has been offered earlier than, and discouraging them from shopping for it. Not very trustless.

For these causes, a greater place to put up proof of possession transfers must be discovered. And what higher choice than the Bitcoin blockchain, an already established trusted public ledger with robust incentives to maintain it censorship-resistant and decentralized?

If we use Bitcoin, we should always not specify a hard and fast place within the block the place the dedication to switch possession should happen (e.g. within the first transaction) as a result of, similar to with the editor of the New York Instances, the miner may mess with it. A greater strategy is to position the dedication in a predefined Bitcoin transaction, extra particularly in a transaction that originates from an unspent transaction output (UTXO) to which the possession of the asset to be issued is linked. The hyperlink between an asset and a bitcoin UTXO can happen both within the contract that points the asset or in a subsequent switch of possession, every time making the goal UTXO the controller of the transferred asset. On this means, we’ve got clearly outlined the place the duty to switch possession ought to be (i.e within the Bitcoin transaction originating from a selected UTXO). Anybody working a Bitcoin node can independently confirm the commitments and neither the miners nor some other entity are in a position to censor or intervene with the asset switch in any means.

Since on the Bitcoin blockchain we solely publish a dedication of an possession switch, not the content material of the switch itself, the vendor wants a devoted communication channel to supply the client with all of the proofs that the possession switch is legitimate. This may very well be finished in a lot of methods, doubtlessly even by printing out the proofs and transport them with a service pigeon, which, whereas a bit impractical, would nonetheless do the job. However the most suitable choice to keep away from the censorship and privateness violations is set up a direct peer-to-peer encrypted communication, which in comparison with the pigeons additionally has the benefit of being simple to combine with a software program to confirm the proofs obtained from the counterparty.

This mannequin simply described for client-side validated contracts and possession transfers is strictly what has been applied with the RGB protocol. With RGB, it’s potential to create a contract that defines rights, assigns them to a number of present bitcoin UTXO and specifies how their possession could be transferred. The contract could be created ranging from a template, referred to as a “schema,” through which the creator of the contract solely adjusts the parameters and possession rights, as is completed with conventional authorized contracts. Presently, there are two sorts of schemas in RGB: one for issuing fungible tokens (RGB20) and a second for issuing collectibles (RGB21), however sooner or later, extra schemas could be developed by anybody in a permissionless vogue with out requiring modifications on the protocol stage.

To make use of a extra sensible instance, an issuer of fungible property (e.g. firm shares, stablecoins, and so forth.) can use the RGB20 schema template and create a contract defining what number of tokens it is going to subject, the identify of the asset and a few further metadata related to it. It may possibly then outline which bitcoin UTXO has the proper to switch possession of the created tokens and assign different rights to different UTXOs, corresponding to the proper to make a secondary issuance or to renominate the asset. Every consumer receiving tokens created by this contract will have the ability to confirm the content material of the Genesis contract and validate that any switch of possession within the historical past of the token obtained has complied with the principles set out therein.

So what can we do with RGB in observe as we speak? Firstly, it allows the issuance and the switch of tokenized property with higher scalability and privateness in comparison with any present different. On the privateness facet, RGB advantages from the truth that all transfer-related information is stored client-side, so a blockchain observer can’t extract any details about the person’s monetary actions (it’s not even potential to tell apart a bitcoin transaction containing an RGB dedication from an everyday one), furthermore, the receiver shares with the sender solely blinded UTXO (i. e. the hash of the concatenation between the UTXO through which she want to obtain the property and a random quantity) as a substitute of the UTXO itself, so it’s not potential for the payer to observe future actions of the receiver. To additional enhance the privateness of customers, RGB additionally adopts the bulletproof cryptographic mechanism to cover the quantities within the historical past of asset transfers, in order that even future homeowners of property have an obfuscated view of the monetary conduct of earlier holders.

When it comes to scalability, RGB presents some benefits as nicely. To start with, many of the information is stored off-chain, because the blockchain is barely used as a dedication layer, lowering the charges that must be paid and which means that every consumer solely validates the transfers it’s focused on as a substitute of all of the exercise of a worldwide community. Since an RGB switch nonetheless requires a Bitcoin transaction, the charge saving could seem minimal, however while you begin introducing transaction batching they’ll shortly develop into large. Certainly, it’s potential to switch all of the tokens (or, extra typically, “rights”) related to a UTXO in the direction of an arbitrary quantity of recipients with a single dedication in a single bitcoin transaction. Let’s assume you’re a service supplier making payouts to a number of customers directly. With RGB, you possibly can commit in a single Bitcoin transaction hundreds of transfers to hundreds of customers requesting several types of property, making the marginal value of every single payout completely negligible.

One other fee-saving mechanism for issuers of low worth property is that in RGB the issuance of an asset doesn’t require paying charges. This occurs as a result of the creation of an issuance contract doesn’t must be dedicated on the blockchain. A contract merely defines to which already present UTXO the newly issued property will probably be allotted to. So in case you are an artist focused on creating collectible tokens, you possibly can subject as many as you need without cost after which solely pay the bitcoin transaction charge when a purchaser exhibits up and requests the token to be assigned to their UTXO.

Moreover, as a result of RGB is constructed on prime of bitcoin transactions, it’s also appropriate with the Lightning Community. Whereas it’s not but applied on the time of writing, it will likely be potential to create asset-specific Lightning channels and route funds by means of them, much like the way it works with regular Lightning transactions.

Conclusion

RGB is a groundbreaking innovation that opens as much as new use instances utilizing a very new paradigm, however which instruments can be found to make use of it? If you wish to experiment with the core of the know-how itself, you need to immediately check out the RGB node. If you wish to construct purposes on prime of RGB with out having to deep dive into the complexity of the protocol, you should utilize the rgb-lib library, which gives a easy interface for builders. When you simply need to attempt to subject and switch property, you possibly can play with Iris Pockets for Android, whose code can be open supply on GitHub. When you simply need to be taught extra about RGB you possibly can try this listing of assets.

It is a visitor put up by Federico Tenga. Opinions expressed are fully their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.