The co-founders of the crypto analytics agency Glassnode consider {that a} Bitcoin (BTC) backside may type after certainly one of two issues happen following the market downturn.

Glassnode co-founders Jan Happel and Yann Allemann, who share the Negentropic deal with, inform their 56,000 X followers that they’re two situations the place Bitcoin may carve a neighborhood backside.

In response to Happel and Allemann, Bitcoin may both steadily drop to the $25,000 vary or witness a extreme liquidation occasion earlier than bottoming out.

“Bitcoin Danger Sign at 100.

Two potential short-term situations:

1. Sluggish bleed to $24,800-$25,000.

2. Quick, aggressive wick that will get purchased up quick. Both approach, we’ll backside out shortly after one performs out. We’ve seen these two situations play out previously at any time when the BTC Danger Sign has hit 100.”

Trying on the analysts’ chart, it seems that BTC tends to witness a corrective transfer when the Danger Sign hits 100.

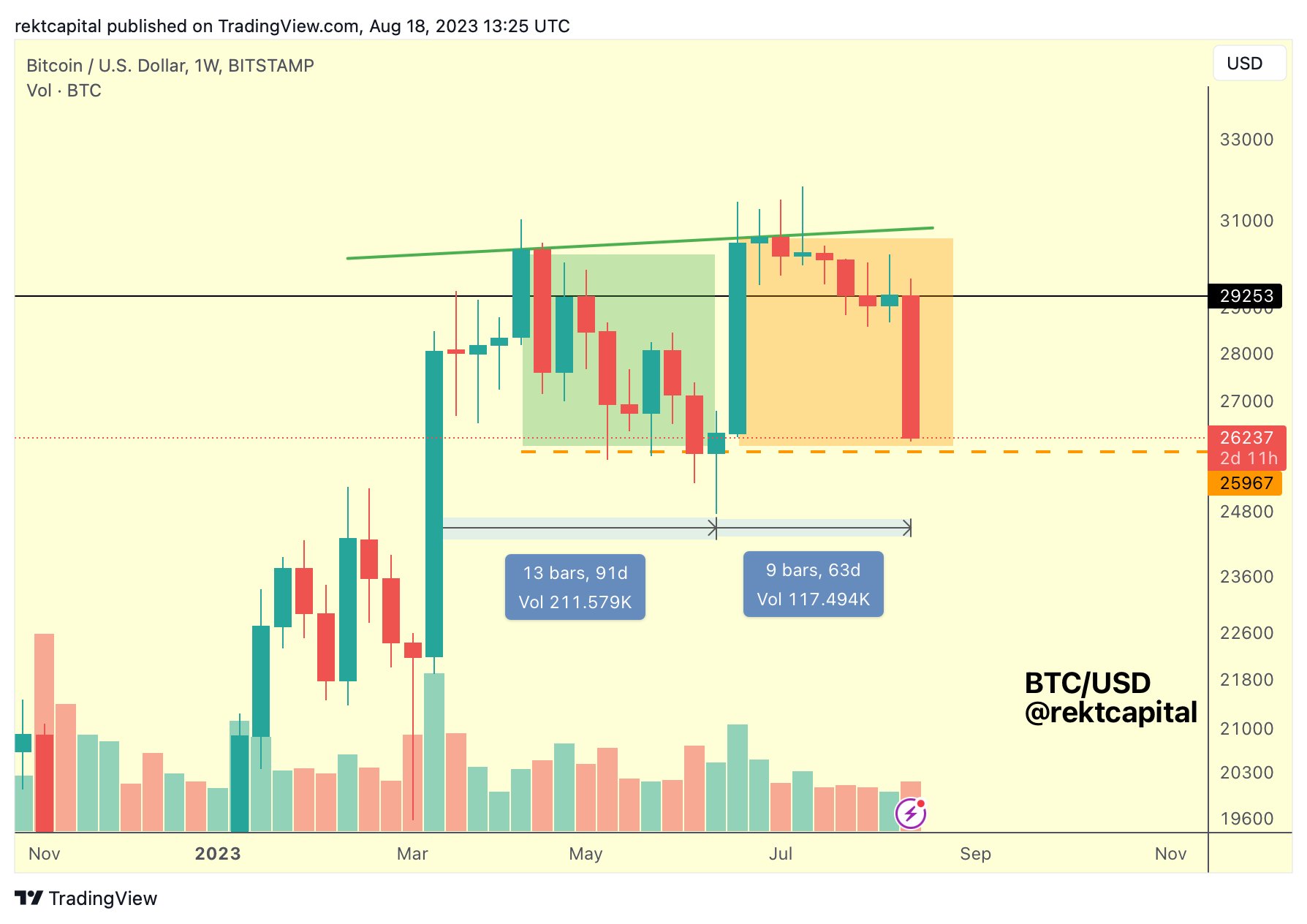

Pseudonymous crypto strategist Rekt Capital can also be weighing in on BTC. In response to the analyst, Bitcoin seems weak after printing a bearish double-top sample.

“It took BTC 91 days to type the primary half of the double prime.

And solely 63 days to type the second half of the double prime.

What’s the takeaway?

The primary half dropped in worth in a step-by-step method, respecting helps however in the end breaking them (inexperienced field).

This latest crash didn’t care about any helps on the best way down (orange field).

There was no response by any means

Simply reveals how weak the buy-side stress is across the orange-boxed area.

Buys aren’t prepared or robust sufficient to correctly step in and alter the course of worth motion.

And present quantity ranges recommend vendor stress hasn’t even reached its peak but.”

Bitcoin is buying and selling for $26,028 at time of writing, down 2.3% within the final 24 hours.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Verify Worth Motion

Observe us on Twitter, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl are usually not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual danger, and any loses you might incur are your accountability. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Day by day Hodl an funding advisor. Please observe that The Day by day Hodl participates in internet online affiliate marketing.

Generated Picture: Midjourney