Sam Bankman-Fried, the disgraced founder of the now-bankrupt crypto trade FTX, maybe might have spent much less time doing media interviews whereas enjoying video video games over the previous few weeks and as an alternative spent extra time Googling extradition treaties. On the very least, he might have spent much less time doing media interviews the place he mentioned he didn’t suppose he could be positioned underneath arrest.

In a Twitter Areas through the day on Monday, Bankman-Fried mentioned, “I don’t suppose I will probably be arrested,” referring to the scandal that has engulfed his enterprise dealings since November, leaving FTX bankrupt and its prospects unable to withdraw funds. Hours later, authorities within the Bahamas, the place Bankman-Fried lives and FTX relies, arrested him following legal prices filed by the US Legal professional’s Workplace of the Southern District of New York. The SEC and CFTC are going after Bankman-Fried, sometimes called SBF, as nicely.

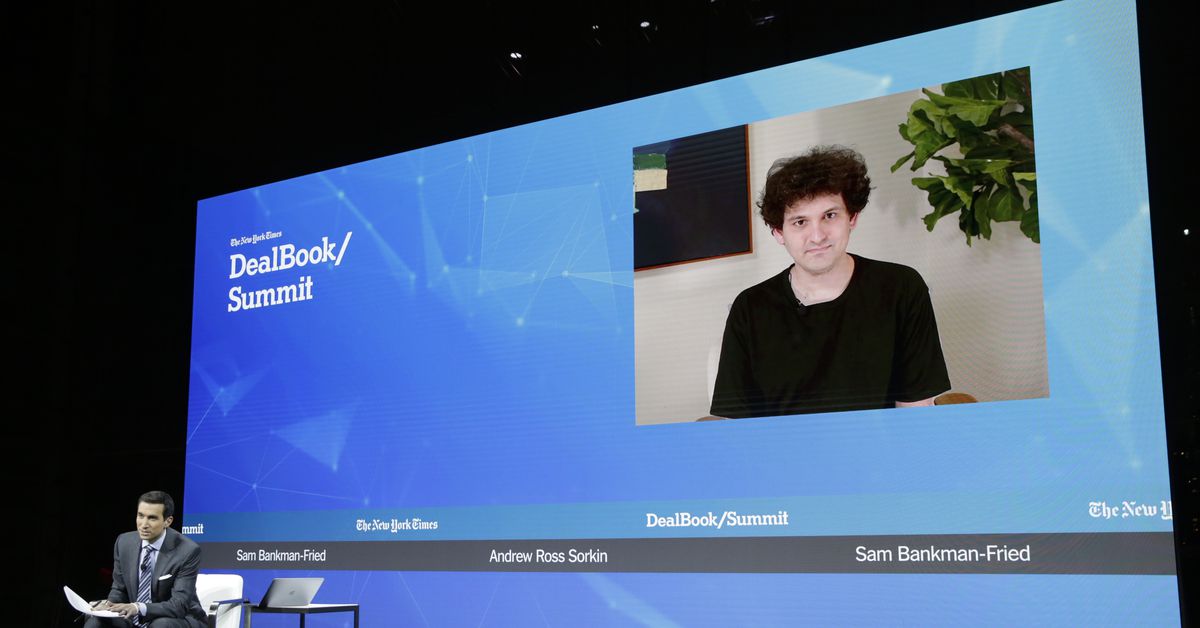

Within the multitude of interviews and Twitter chats Bankman-Fried has performed with the media in latest weeks, he’s been cagey however informal in discussing his liabilities within the state of affairs. “What occurs occurs. That’s lower than me,” he advised Puck’s Teddy Schleifer in an early December interview, when requested whether or not he thought somebody ought to go to jail over the FTX debacle. When the New York Instances’s Andrew Ross Sorkin requested him days earlier whether or not he was involved about potential legal culpability, he replied, after some bumbling, “It sounds bizarre to say it, however I believe the actual reply is it’s not what I’m specializing in.”

The hubris is unattainable to disregard.

The 30-year-old MIT graduate has squandered the funds of a whole bunch of hundreds of his prospects, most of whom are unlikely to see a lot, if any, of their a reimbursement. He’s regularly mentioned he’s sorry and that he “fucked up,” however an oops doesn’t excuse or clarify billions of lacking {dollars}, misused funds, or the intense prices of fraud towards him. His apologies are additionally in battle with a lot of his actions, earlier than FTX’s collapse and after, as he has continued to forged blame elsewhere for what occurred.

FTX seems to have been fairly the alternative of the secure, upright crypto establishment Bankman-Fried mentioned it was. His refusal to take full duty, even now, speaks to the scale of his ego.

Bankman-Fried’s phrases don’t replicate his actions all through his time at Alameda and FTX

Bankman-Fried spent monumental quantities of cash and private capital to construct up his profile and his model. He slapped FTX’s title on something he might, together with the Miami Warmth’s area, and put his face in advertisements. He forged himself as an excellent do-gooder, being profitable hand over fist in crypto with a view to direct it to the philanthropic endeavors he and others in his interior circle most well-liked. (Disclosure: This August, Bankman-Fried’s philanthropic household basis, Constructing a Stronger Future, awarded Vox’s Future Good a grant for a 2023 reporting challenge. That challenge is now on pause.)

All of the whereas, he was, allegedly, committing severe crimes, together with wire fraud, securities fraud, and cash laundering, and mixing funds of his cryptocurrency trade, FTX, with these of the buying and selling agency he based, Alameda Analysis. Based on the SEC’s criticism towards Bankman-Fried, “From the inception of FTX, Bankman-Fried diverted FTX buyer funds to Alameda, and he continued to take action till FTX’s collapse in November 2022.”

In different phrases, Bankman-Fried’s assertions that he wasn’t conscious of what was happening with FTX and Alameda mixing funds and that the trade went underneath as a result of he was asleep on the wheel are, if the allegations towards him are to be believed, a lie. “Whereas he spent lavishly on workplace house and condominiums in The Bahamas, and sank billions of {dollars} of buyer funds into speculative enterprise investments, Bankman-Fried’s home of playing cards started to crumble,” the criticism reads.

After positioning himself as the intense and secure face of crypto on Capitol Hill and amongst regulators, Bankman-Fried has additionally been charged with marketing campaign finance violations and allegations that he made extra donations than the permitted quantity, together with through the use of different individuals’s names. It’s a picture of a man who was nicely conscious of the principles and guardrails round him — he’s fairly fluent in regulatory converse — and appeared to imagine they didn’t or shouldn’t apply to him.

In an interview with Vox’s Kelsey Piper in November carried out through Twitter direct message, he declared, “Fuck regulators. They make all the pieces worse.” These are phrases he may come to remorse because the regulators at the moment are coming after him. Then once more, given his cavalier perspective, who is aware of?

The blame sport continues

In testimony he was set to ship earlier than a Home Monetary Providers Committee listening to previous to his arrest that was printed by Forbes, Bankman-Fried purports to simply accept duty for FTX’s collapse however repeatedly casts blame elsewhere. It begins with the road that’s change into typical for Bankman-Fried — “I fucked up” — after which goes on a winding path that swings between accepting fault and abdicating duty.

Bankman-Fried repeats his remorse that FTX filed for Chapter 11 chapter and laments that the corporate, which is now being run by John J. Ray III, who helped handle Enron after its 2001 collapse, has rebuffed his presents to assist repair the catastrophe he created. He claims he would have been capable of “simply acquire some items of the info” FTX has been unable to search out. In a Trump-esque vogue, he at instances displays an “I alone can repair it” perspective — regardless that in different moments of this saga, when handy, he’s been very cautious to notice that on sure objects he wasn’t paying consideration.

Bankman-Fried says that he’s nonetheless conscious of “billions of {dollars} of great presents for financing” to make prospects “considerably complete,” however that might require the corporate be restarted as an trade. It’s not clear who these presents are supposedly from. After which, his testimony but once more locations blame elsewhere for these magic, mysterious new funds not showing. “I admit I’m not optimistic about some components of the method,” he says. “I’ve not myself witnessed any progress by Mr. Ray’s group towards elevating substantial funds or restarting the trade.”

Ray has been slicing and candid in his evaluation of what occurred with FTX as he learns extra particulars. In his testimony earlier than the Home Monetary Providers Committee on Tuesday, December 13 (the listening to Bankman-Fried was additionally supposed to seem at), Ray mentioned that FTX went on a $5 billion “spending binge” in late 2021 by 2022, and that loans and different funds over $1 billion have been made to insiders. He mentioned that FTX’s collapse stemmed from the “absolute focus of management within the arms of a really small group of grossly inexperienced and unsophisticated people who did not implement just about any of the methods or the controls which are vital for a corporation that’s entrusted with different individuals’s cash or property.” Ray additionally mentioned on the Home listening to that FTX used QuickBooks for accounting. There was, he says, “no sophistication” and an “absence of any administration” at FTX.

A lot of Bankman-Fried’s phrases and actions in latest weeks have been on the very least petty and infrequently borderline delusional. He’s taken swipes at Binance, the competitor that partly spurred FTX’s collapse, accusing its CEO of mendacity and claiming the corporate, which briefly entertained shopping for FTX, by no means meant to go forward with the deal. (Bankman-Fried apart, Binance is dealing with troubles of its personal.)

In his ready testimony, he says FTX’s new management is “damaging.” He appears to forged Ray and others as racist, declaring their transfer to grab property from FTX out of the Bahamas and to america equates “malign intent and incompetence on the a part of different races, cultures, and governments” that might be “thought-about deeply offensive if directed at American minorities.”

Possibly he thought he might get away with this as a result of that’s typically how issues work

On reflection, it’s exhausting not to take a look at Bankman-Fried now and surprise how he was capable of pull all of this off. The reply is just that he was allowed to.

He managed to lift $2 billion from buyers, together with large names like Sequoia, Tiger International, and SoftBank, who it will seem did not look very carefully underneath the hood. He was the topic of a number of largely flattering profiles that marveled at his schlubby look and obvious dedication to the efficient altruism philosophy and philanthropic causes. Media retailers proceed to notice that his dad and mom are Stanford legislation professors and that he grew up in good, rich, liberal circles, as if that upbringing has some form of essential that means.

Given all of this, it is smart why Bankman-Fried definitely earlier than and even now has displayed such audacity in his enterprise selections and private actions. When you inform all people you’re superior and have completely obtained this, and all people round you is consistently reinforcing that you just’re superior and have completely obtained this, you may very nicely be inclined to go together with it. If the principles have by no means utilized to you, why would they begin now? You obtain wunderkind standing, and also you discover no one round you is admittedly kicking the tires on how you bought there, so that you roll with it — even when that possibly entails doing a little alleged large crimes.

What lies forward for Bankman-Fried is unclear. He seems to be in quite a lot of bother, and he’ll have a group of in all probability excellent legal professionals to defend him in court docket (although how a lot he’ll heed their recommendation is an open query). On the very least, he’ll in all probability have to sit back on the media interviews and tweeting for some time. Although given his love for talking with the press — and the press’s love for talking with him — it will possible not be the final time we’ll hear from him.

Maybe the larger query to ask past Bankman-Fried himself is how he was capable of obtain such standing within the first place, to show such vanity with out ever worrying it will come earlier than a fall. Possibly the scarier factor is that guys like this get away with stuff like this on a regular basis. There may be an SBF 2.0 lurking across the nook, however extra possible, there are just a few hiding in plain sight proper now.