Authored by:

Shannon Kurtas, Product Director, Professional & Institutional Buying and selling

Max Kaplan, Sr. Engineering Director, Core Infrastructure & Knowledge Engineering

Suketu Gandhi, Sr. Engineering Director, Buying and selling Expertise

Steve Hunt, VP Engineering

Almost twelve years in the past, Kraken started its pioneering mission to turn out to be one of many first and most profitable digital asset exchanges. We began buying and selling solely 4 cryptocurrencies, however we now help over 220 belongings on 67 blockchains, and over 700 markets.

We’ve grown rapidly. Because of our product and engineering groups — together with consultants in blockchain expertise, safety, networking, infrastructure, and buying and selling programs — we’ve been capable of sustain with large demand.

Because the {industry} has matured and advanced, so has the scale and nature of our consumer base. Whereas we proceed to serve particular person buyers and merchants through our Kraken and Kraken Professional platforms, a rising a part of our order move arrives algorithmically through our API from skilled and institutional purchasers. These embody companies, hedge funds, proprietary buying and selling corporations, prime brokers, fintechs, in addition to different exchanges counting on Kraken’s deep liquidity.

Our buying and selling programs have needed to scale to fulfill these elevated calls for, significantly for those who closely depend upon velocity, stability, and uptime in an effort to enhance execution prices, handle market threat, and capitalize on buying and selling alternatives. We achieved all of this with out compromising on our primary precedence — safety.

Right this moment, we’re delighted to focus on a few of our current efforts, successes, and outcomes of that scaling.

The primacy of efficiency

We put vital emphasis on instrumenting code to observe and perceive our system efficiency beneath heavy, real-world circumstances. We additionally make use of aggressive benchmarking to verify how we stack up over time. Let’s discover a few of these outcomes.

Pace and latency

We measure buying and selling velocity within the type of latency. Latency is the round-trip delay and we outline it because the time between a buying and selling request (e.g., add order) being despatched by consumer programs and it being acknowledged by the change.

In contrast to conventional exchanges, crypto venues are typically much less geographically concentrated and don’t supply full colocation. In lots of instances, they’re solely cloud-based.

Latency-sensitive purchasers will deploy code wherever it’s most bodily proximate to the venue. Subsequently, a good comparability contains measuring latency from the area most related for that particular venue.

Latency may even fluctuate between buying and selling requests, even on a persistent connection between a single consumer and the change. This is because of each variations and variability in internet-based buying and selling, in addition to how the change is dealing with load. Subsequently, we should talk about latencies when it comes to percentiles somewhat than single figures. For instance, P25 latency refers back to the Twenty fifth-percentile latency. In different phrases, a P25 of 5ms signifies that 25% of all buying and selling requests inside a given sampling timeframe had a latency of 5ms or higher.

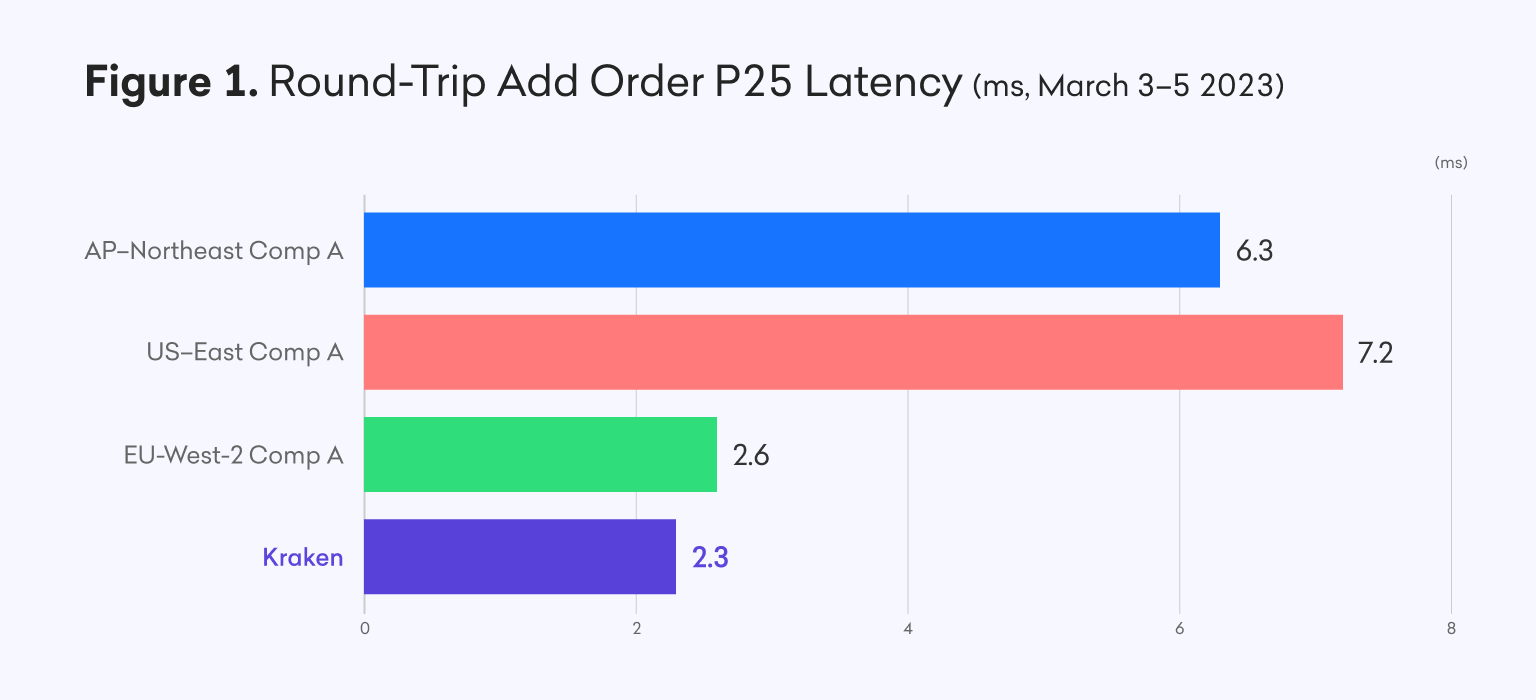

Right here you see Kraken’s finest path P25 latency versus a few of our high rivals in numerous areas, normalized for location, throughout a baseline measurement final month.

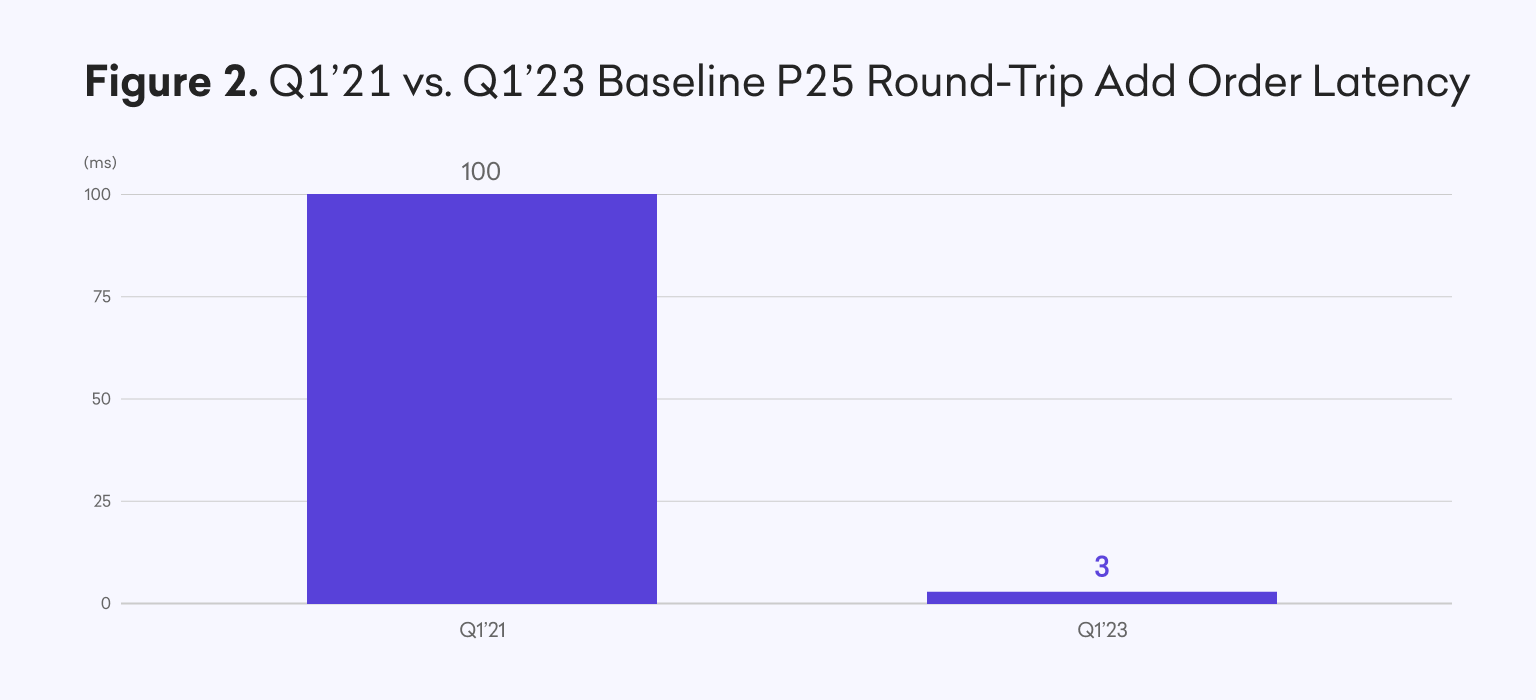

Our baseline round-trip latency of about 2.5ms represents over a 97% enchancment vs. Q1 2021.

Stability

As talked about earlier than, real-world efficiency beneath heavy load is as vital, if no more vital, than finest case efficiency and absolute latency figures.

Bettering execution price, decreasing slippage, and managing market threat is dependent upon minimizing the variability of latency between every buying and selling request. We name this variability jitter, and we measure the distinction between totally different latency percentile figures for a similar sampling timeframe.

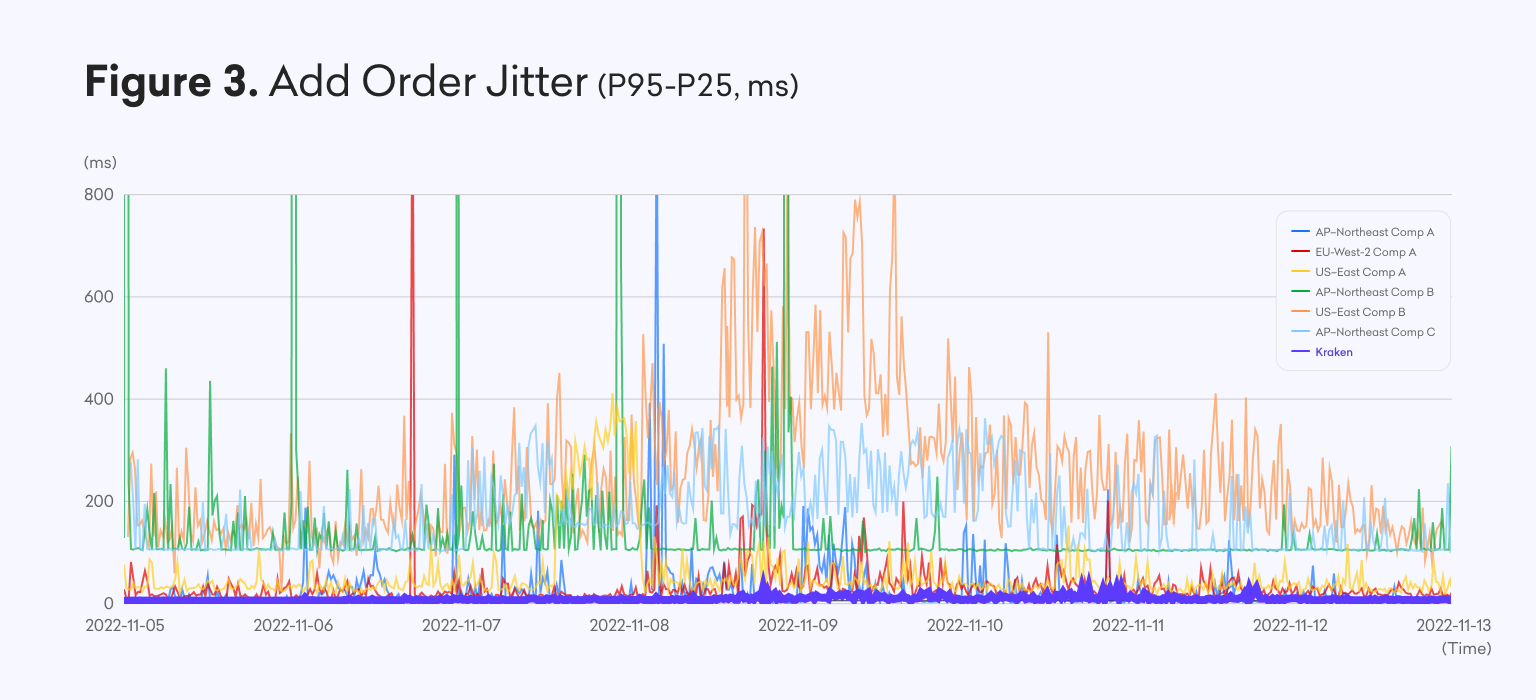

By measuring jitter with P25 and P95 latencies, we are able to seize a big vary of efficiency and noticed conduct over time. For instance, we measured how our jitter stacked up with a broader set of high rivals through the week of 5-12 November 2022, a time when market volatility was acute as a result of misery and supreme shutdown of FTX.

Right here you may see how our buying and selling infrastructure behaved exceptionally nicely, regardless of the dramatically elevated volatility and cargo. At no level through the week did this jitter exceed 30ms. In the meantime, for a lot of different exchanges, it repeatedly reached a number of hundred milliseconds, or requests timed out solely as indicated by the vertical spikes.

Throughput

Throughput displays the variety of profitable buying and selling requests (add order, cancel order, edit order, and so on.) dealt with by an change in a given period of time.

Just like latency, we talk about throughput in both theoretical or noticed phrases.

Noticed throughput is extra related because it displays many interrelated elements together with fee limits. We set these limits to forestall DDoS assaults and maintain site visitors comfortably inside theoretical limits. Dimension of the consumer base, normal market demand, order move (which is impacted closely by value volatility and buying and selling exercise elsewhere), and efficiency beneath load (since past a sure degree of service degradation, purchasers would begin throttling their very own requests) all have an effect on these limits.

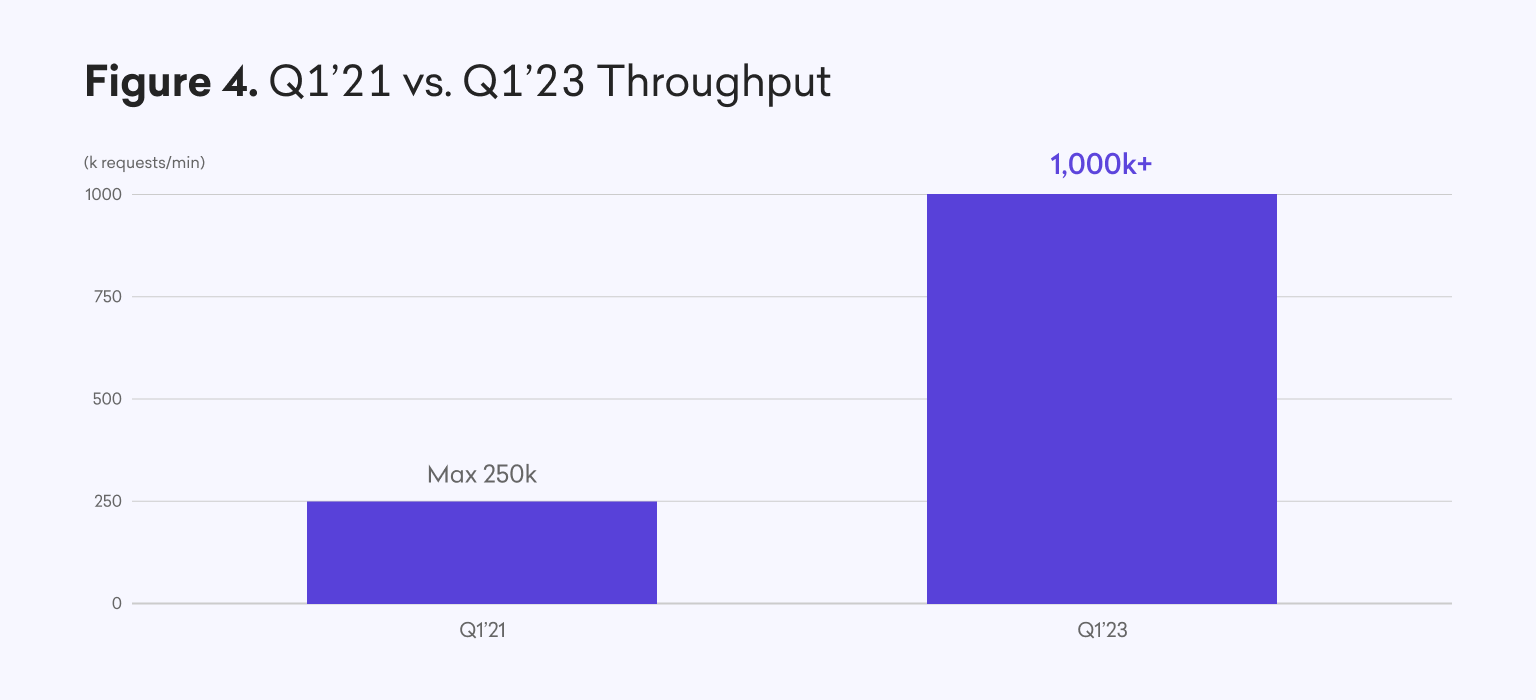

Right here we’ve illustrated the over 4x enchancment in our most noticed throughput between Q1 2021 and Q1 2023. This alteration is a transfer from 250k requests/min to over 1mm requests/min, and there’s vital headroom left between this degree and our dramatically improved theoretical most throughput.

Uptime

This yr, we made efforts to attenuate downtime as a consequence of deliberate upkeep, cut back the frequency and affect of unscheduled downtime, and enhance the rate of characteristic updates and efficiency enhancements with out negatively impacting uptime.

These modifications included each technical and operational enhancements, equivalent to an more and more mature and huge operational resilience crew which operates 24/7.

Whereas uptime for our worst month in 2021 was near 99%, these enhancements have allowed us to set more and more aggressive error budgets and a buying and selling uptime goal of 99.9+%.

Efforts

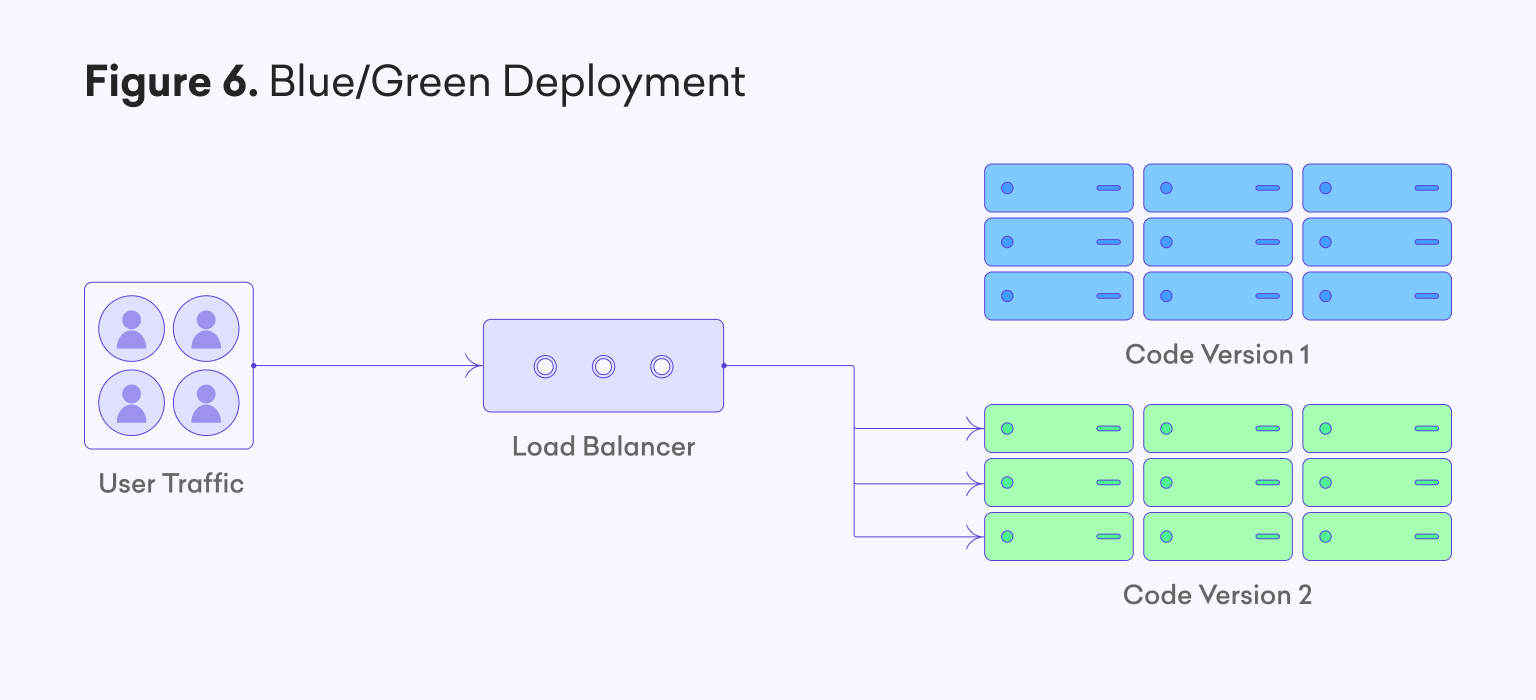

Blue/inexperienced and rolling deployments

We now have made rising use of a blue/inexperienced deployment technique throughout our API gateways and plenty of inside providers. You may see a really simplified illustration of that is highlighted in Determine 6. By working a number of fully-fledged code stacks in parallel, we are able to deploy options with out disturbing the primary stack which is presently receiving consumer site visitors. Afterward, site visitors will be re-routed to the brand new stack, resulting in a zero-impact deployment, or a really fast rollback process ought to something go mistaken. Moreover, for our many providers which function a number of cases for functions of load balancing, updates to those cases occur on a rolling foundation somewhat than all-or-none. These approaches now permit us to conduct zero-impact, and extra frequent updates, to the overwhelming majority of our tech stack.

Infrastructure as Code

Kraken closely leverages Infrastructure as Code (IaC) with Terraform and Nomad, largely to ensure consistency of all code deployments in addition to repeatability. We automate our Terraform repositories with steady integration and steady supply so we are able to roll modifications out rapidly and reliably. For the previous two years, we’ve got deployed new infrastructure utilizing IaC and practically all of our infrastructure as we speak makes use of this sample. This transfer was a significant milestone and we leverage IaC for each cloud-based and on-premise purposes.

Connectivity and networking

We leverage personal connectivity between AWS and our on-premise information facilities. This connectivity permits Kraken to ensure we’ve got the bottom attainable latency, highest attainable safety, and redundant paths to verify we are able to attain out to AWS always. Current networking and routing enhancements have enabled a big a part of the baseline round-trip buying and selling latency discount highlighted above.

Instrumentation and telemetry

Effective-grained and correct logging, metrics, and request tracing have allowed us to rapidly establish, diagnose, and resolve any sudden bottlenecks and efficiency points in real-time. Past this telemetry and our personal aggressive monitoring, we’ve additionally just lately up to date our API latency and uptime metrics on standing.kraken.com with exterior monitor deployments to, usually, extra precisely mirror these numbers as skilled by purchasers.

Optimized API deployments

At any given second, our APIs and buying and selling stack help tens of hundreds of connections buying and selling algorithmically by means of our Websockets or REST APIs. Lots of of hundreds extra connections come from our UI platforms, together with our new high-performance Kraken Professional platform. Whereas these platforms reap most of the identical core buying and selling infrastructure advantages described on this publish, the workloads are basically totally different and have totally different necessities. Bespoke API deployments to help our UI platforms, with particular information feeds, compression, throttling, aggregation, and so on have allowed us to additional enhance velocity and cut back wasted bandwidth, and due to this fact enhance total consumer capability.

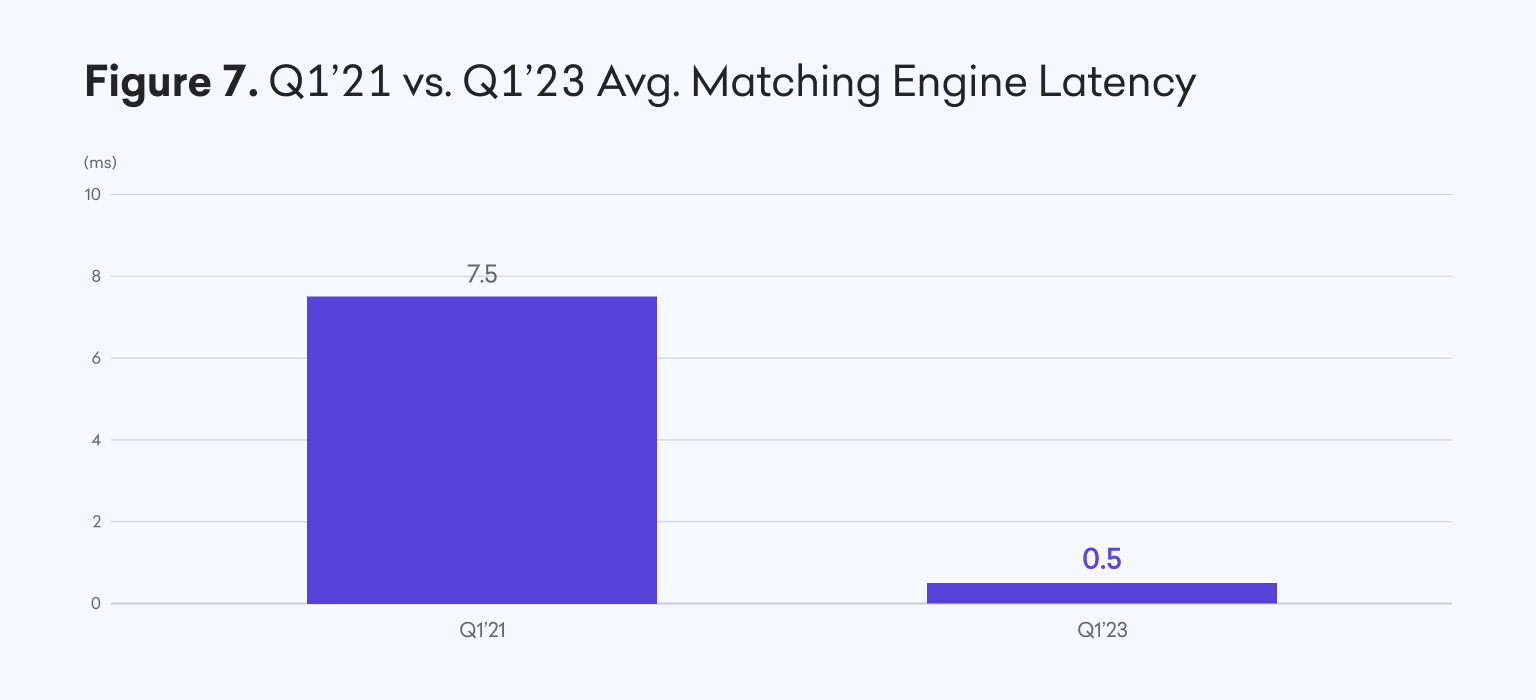

Core code enhancements

We now have made a spread of additional, dramatic enhancements throughout the stack by means of re-engineering core providers in Rust and C++. These modifications make elevated use of asynchronous messaging and information persistence the place attainable and assist us construct sturdy efficiency profiling into extra of our CI/CD pipelines. In addition they lets us make use of finest identified strategies for static and dynamic code evaluation. A number of of those enhancements have culminated within the matching engine’s common latency dropping from milliseconds to microseconds. This a greater than 90% enchancment vs two years prior, whereas supporting over 4x the throughput.

What’s subsequent?

Native FIX API

We’ll additionally quickly be launching our native FIX API for spot market information and buying and selling. FIX, which stands for Monetary Info Change, is a robust and complete however versatile industry-standard API that many establishments use for buying and selling equities, FX, and stuck revenue at an enormous scale. It’s a trusted and battle-tested protocol, with broad third celebration software program and open supply help, making it simpler and faster for establishments to combine with Kraken and start buying and selling.

Kraken’s native FIX API additionally comes with architectural nuances and advantages relative to our Websockets and REST APIs, together with session-based cancel-on-disconnect, assured in-order message supply, session restoration, and replay. Our FIX API is presently in beta testing — attain out for those who’d like to assist kick the tires!

Zero-downtime matching engine deployments

We’ve made vital inroads on the frequency of zero-impact deployments of API gateways and varied backend providers (authentication, audit, telemetry, and so on.). Materials updates to our matching engine, although, nonetheless require scheduling upkeep and temporary downtime, which we supply out roughly biweekly.

Nonetheless, our crew underwent a big effort to re-engineer a few of our inside messaging programs with multicast expertise, making use of Aeron, an especially performant and sturdy suite of instruments for fault-tolerant excessive availability programs. The results of this will likely be zero-downtime deliberate deployments throughout the buying and selling stack, accessible later in 2023.

Need assistance? Attain out

Please attain out to our account administration and institutional gross sales groups utilizing the e-mail handle [email protected] to study extra about any of those updates, to debate find out how to optimize your buying and selling connectivity, or to beta check forthcoming options like our FIX API.

Want extra proof? Maintain an eye fixed out and subscribe to updates on standing.kraken.com for any deliberate upkeep, service data and latency and uptime statistics.