The good contract token financial system rose 5.6% in opposition to the U.S. greenback on Thursday, reaching $332 billion. Moreover, the worth locked in decentralized finance (defi) elevated to almost $50 billion, a document excessive not seen for the reason that collapse of FTX.

Sensible Contract Financial system and Defi TVL Bounces Again

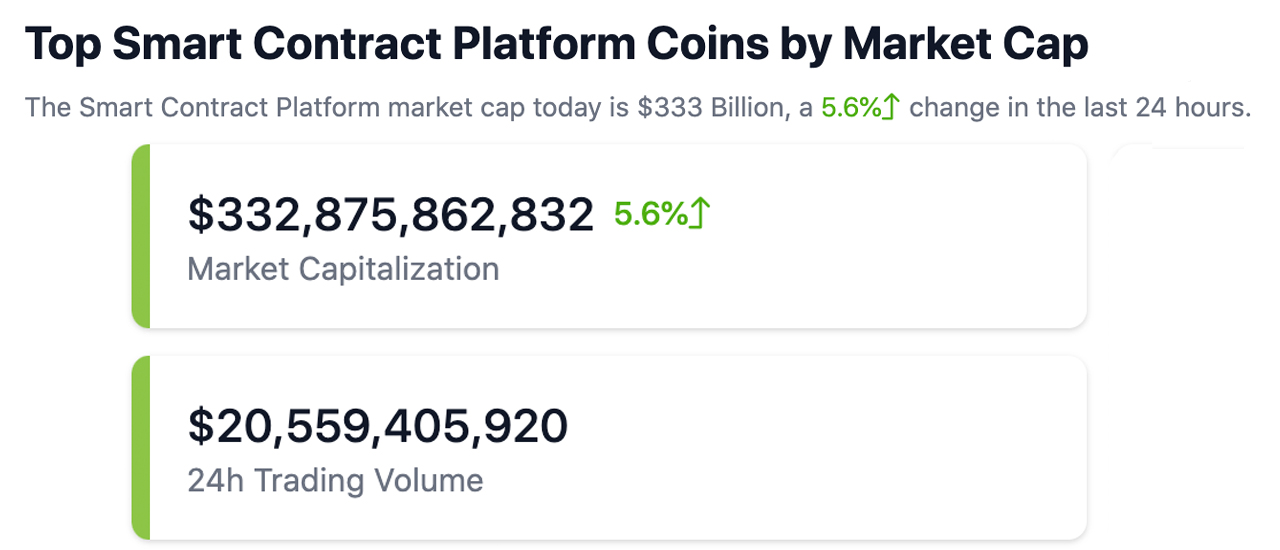

On Thursday, Feb. 2, 2023, the highest good contract platform coin financial system elevated to $332.86 billion, an increase of 5.6% within the final 24 hours. At the moment, roughly $20.44 billion in international buying and selling quantity is paired with good contract tokens. Of the highest ten good contract crypto property by market capitalization, polygon (MATIC) led in 24-hour positive aspects, rising 12% within the final day. Aptos (APT) adopted with the second-largest enhance, leaping 10.4% larger on Thursday.

Polkadot (DOT), chainlink (LINK), and solana (SOL) all skilled notable positive aspects within the final day, leaping 6% to 7.1% larger. Sensible contract cash exterior the highest ten that noticed vital will increase embody close to protocol (NEAR), which rose 11.4%, and fantom (FTM), which jumped 17.5% on Thursday. Parsiq (PRQ) was the biggest gainer with a 27.7% enhance, whereas counterparty (XCP) was the largest good contract token loser, shedding 9.9% on Thursday.

The worth locked in decentralized finance (defi) has additionally risen and is close to the $50 billion vary, at roughly $49.48 billion. Lido Protocol leads the defi pack, as its whole worth locked (TVL) at the moment represents 17.32% of the $49 billion on Thursday.

Lido’s TVL elevated by 5.79%, and the second-largest defi protocol, Makerdao, jumped 2.97% in 24 hours. Rocket Pool skilled one of many largest defi protocol will increase within the final day with a 7.38% rise. In line with defillama.com statistics, the highest 20 defi protocol TVLs have all seen double-digit will increase within the final 30 days.

Ethereum stays the high chain in decentralized finance at the moment, as its defi protocols dominate the full worth locked (TVL) by 59.4%. Ethereum is adopted by Tron, Binance Sensible Chain (BSC), Arbitrum, and Polygon, respectively, by way of TVL measurement on Feb. 2, 2023.

Modifications over the previous month present that the highest ten blockchains by way of defi TVL have additionally seen double-digit will increase in TVL. The biggest enhance within the final month was Optimism’s TVL, which elevated by 47.41% over the 30-day span. The final time the TVL in defi was this excessive was in Nov. 2022, simply earlier than the crypto trade FTX collapsed.

What do you concentrate on the market performances of good contract tokens on Feb. 2 and the rise in defi’s TVL? Share your ideas within the feedback sections under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any injury or loss brought about or alleged to be brought on by or in reference to using or reliance on any content material, items or providers talked about on this article.