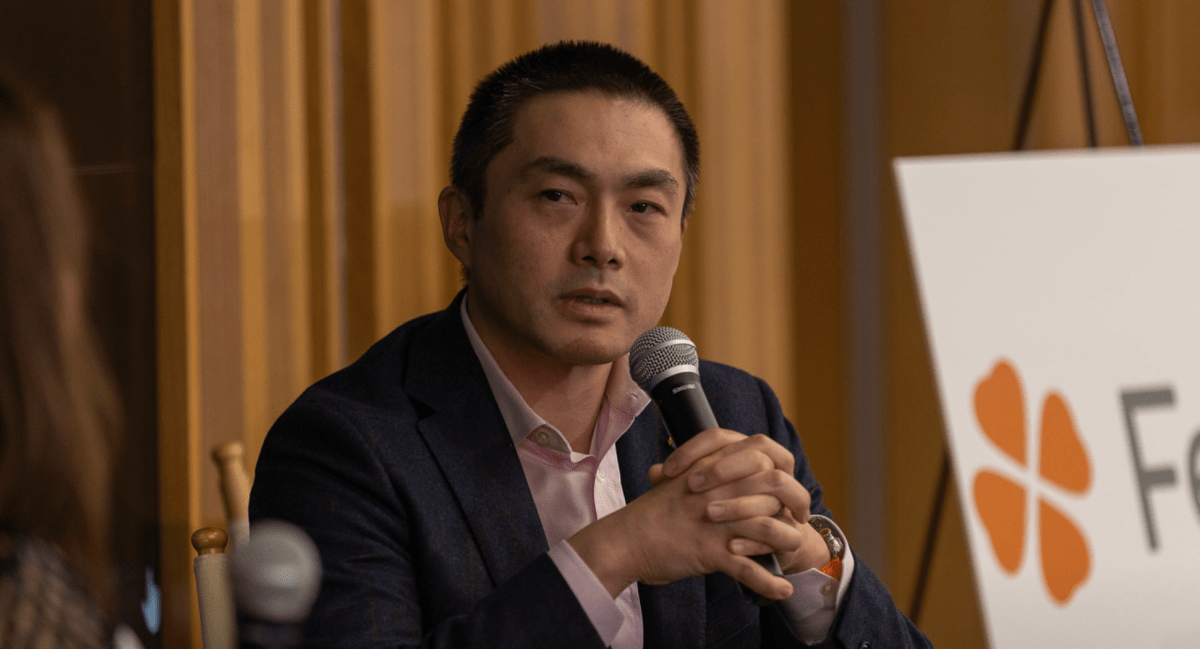

Final night time, at an business occasion hosted in San Francisco by this editor, enterprise capitalist Alfred Lin of Sequoia Capital sat down for a fireplace dialog in regards to the evolution of his storied funding agency, which has loved a largely unblemished report of gorgeous success — a report since marred by its roughly $200 million funding within the crypto forex trade FTX.

The funding, as soon as a supply of pleasure for the agency, has tarnished not Sequoia but in addition Lin, who led the deal on behalf of Sequoia, was the agency’s level of contact with CEO Sam Bankman-Fried for a year-and-a-half and who spoke thoughtfully yesterday about how he feels at this time a few wager gone so improper.

Requested, for instance, whether or not wanting again, there have been indicators that Lin sees now that he missed earlier, he answered after a pause: “I assumed [Bankman-Fried] was very sensible . . . he solutions questions very logically and really succinctly. May we’ve got noticed any tells? I don’t know. There’s what I do know at this time and what I knew on the time. If I knew on the time, we wouldn’t have invested. So at this time, I feel the factor that will get me to reassess is . . . it’s not that we made the funding. It’s the year-and-a-half working relationship afterward, and I nonetheless didn’t see it. And that’s tough.”

If it was notably difficult for Lin on condition that only a 12 months earlier, he topped Forbes’s annual Midas Record, he didn’t say so. However he advised that have stays disturbing to him as a result of Bankman-Fried appeared to grab on what the enterprise business sees as one in all its biggest strengths.

Defined Lin, it’s “a belief enterprise. And sure, we have to belief and confirm, and we attempt to confirm what we will. However we begin from a place of belief, as a result of if we don’t belief the founders that we work with, why would you ever spend money on them?”

Picture Credit: Dani Padgett (opens in a brand new window)

Lin had much more to say about FTX, together with whether or not he has sympathy for Bankman-Fried. He defended Sequoia’s determination to handle its positions in its portfolio corporations nicely previous the purpose that they go public.

Lin additionally confirmed in the course of the occasion that in a gesture to its restricted companions, Sequoia final 12 months diminished its administration charges on two funds that it rolled out a 12 months in the past — a $950 million ecosystem fund that it makes use of to again different managers’ funds and a $600 million crypto fund. Lin mentioned that reasonably than cost its backers on dedicated capital, which is customary within the business, it’s charging them administration charges on their dedicated capital alone. (On that entrance, he mentioned that simply 10% of the crypto fund has been deployed, including that Sequoia stays “long-term optimistic” about crypto.)

Lastly, Lin shared his views concerning how generative AI — one of many buzziest areas of curiosity for the enterprise business proper now — is altering the chance for each VCs and buyers.

Full video of the dialog follows.