Whereas the stablecoin market has seen important redemptions previously three months, the provision of tether, the most important stablecoin by market capitalization, has elevated by 2.46 billion since mid-November 2022. Tether is the one one of many high 5 stablecoins by market valuation that has seen a provide enhance previously three months.

Tether Provide Rises Whereas Competitor Stablecoins See Declines

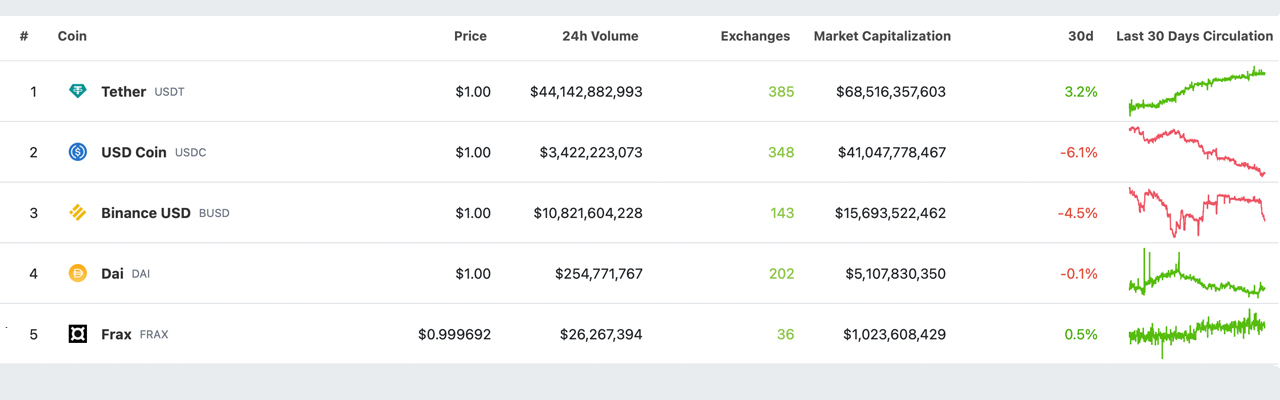

A lot has modified previously three months following the collapse of FTX and its aftermath. The stablecoin financial system has skilled important redemptions, and 30-day statistics from February 14, 2023, present that three of the highest 5 stablecoins have seen a decline of their market capitalizations. The affected stablecoins are usd coin (USDC), binance usd (BUSD), and DAI. Whereas BUSD skilled important redemptions after the announcement that Paxos would now not mint the stablecoin, USDC noticed the most important decline, shedding 6.2% within the final month. BUSD decreased by 4.5% within the final 30 days, and DAI had a slight lower of 0.1%.

Tether (USDT), then again, has seen a 3.2% enhance in provide over the past 30 days. Actually, over the previous three months, USDT’s provide has grown by 3.74%. Collectively, the highest 5 stablecoins make up nearly all of the stablecoin financial system and the considerably giant commerce quantity of dollar-pegged tokens. On November 17, 2022, USDT’s circulating provide was round 65.94 billion, and after a 3.74% enhance, it has risen to 68.41 billion at this time. Whereas USDT’s provide has grown over the previous three months, the underside 4 stablecoins haven’t seen any development and, the truth is, have all skilled declines.

For instance, usd coin’s circulating provide on November 17, 2022, was round 44.40 billion, however it has since dropped to the present 40.98 billion. BUSD had a circulating provide of 23.03 billion on November 17, 2022, and it’s now roughly 15.69 billion, a lower of 31.87%. Makerdao’s DAI token has a circulating provide of 5.09 billion at this time, in comparison with 5.44 billion three months in the past, a 6.43% lower. The fifth-largest stablecoin by market valuation, FRAX, had a circulating provide of 1.177 billion on November 17, 2022, and now has 1.024 billion as of February 14, 2023, a lower of 12.99%.

Over the previous 5 years, stablecoins have enormously expanded, with some dollar-linked tokens failing to endure. The soundness of the reserve and the issuer’s capacity to uphold it are essential elements in a stablecoin’s success. The Terra UST collapse of 2022 underlined this significance, and the previous yr has demonstrated that the stablecoin financial system is enormously impacted by exterior elements like financial circumstances, market volatility, and regulatory developments.

What are your ideas on Tether’s current provide development in comparison with the remainder of the stablecoin market? Share your ideas within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any injury or loss brought on or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or providers talked about on this article.