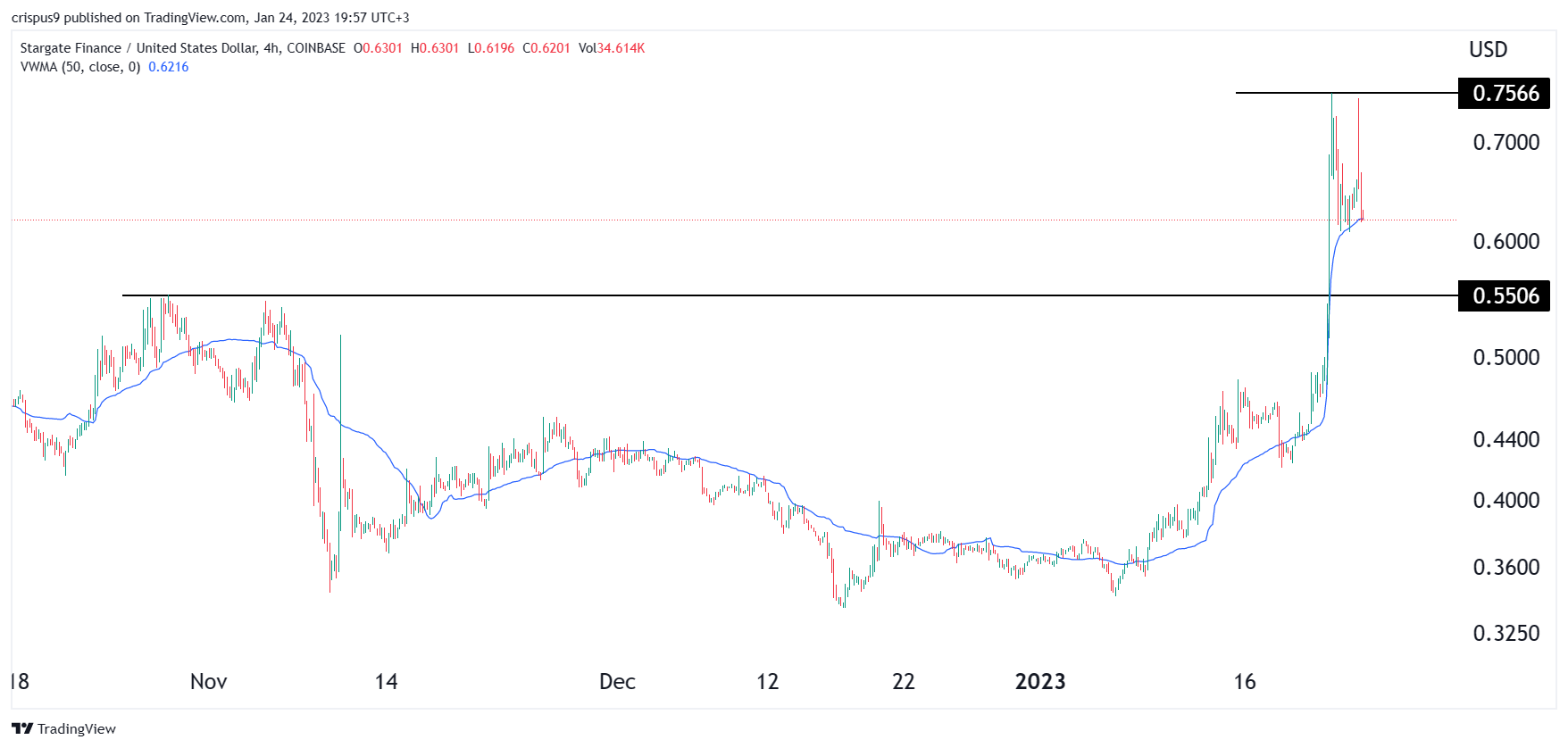

STG value surged to a excessive of $0.7566 this week as curiosity in DeFi tokens jumped. Stargate Finance’s native token has risen by over 85% from the bottom level in 2022. So, what’s Stargate and why is the token hovering?

What’s Stargate Finance?

DeFi has emerged as one of the vital essential areas within the blockchain trade. The truth is, with the metaverse and NFTs struggling, it’s the solely bastion of hope for the sector. Whereas the quantity of belongings held in DeFi has dropped just lately, it’s nonetheless value about $70 billion. And DEX protocols like dYdX and Uniswap are dealing with a whole bunch of hundreds of thousands of {dollars} each day.

Stargate Finance is a little-known platform within the DeFi trade. It exists in quite a few blockchains like Ethereum, Avalanche, BNB Chain, Arbitrum, and Optimism. Like most cross-chain blockchains, Ethereum is essentially the most dominant participant in Stargate, the place it has a TVL of greater than $102 million.

Stargate Finance is a DeFi protocol that makes it doable for customers to stake, farm, and switch tokens throughout a number of chains. It describes itself as a completely composable liquidity transport protocol that lives on the coronary heart of the omnichain.

As such, you possibly can swap tokens on a 1:1 foundation and add liquidity to Stargate’s Omnichain protocol and earn stablecoin rewards. Additionally, liquidity suppliers can farm their LP tokens in change for STG rewards. Prior to now few months, the entire worth locked (TVL) in its ecosystem has dropped from over $4 billion to about $379 million.

It’s unclear why Stargate Finance token has soared prior to now few days. A probable motive is {that a} short-squeeze is happening. As I defined on this article, now we have just lately seen a number of quick sale liquidations within the crypto trade.

Stargate Finance value prediction

STG value has gained momentum prior to now few months as demand for the coin rises. Because it surged, it managed to maneuver above the important thing resistance degree at $0.5506, the very best level on October 29. It additionally rose above all transferring averages. However now, the token is forming a double-top sample whose higher facet is at $0.7566. This sample is normally a very good predictor of a bearish transfer.

Due to this fact, I think that the token will quickly have a bearish breakout, with the subsequent key resistance degree to observe being at $0.60.