Welcome to this week’s Market’s Compass Rising Market’s Nation ETF Research, Week #409, that’s being revealed in my Substack Weblog. It’s going to spotlight the technical adjustments of the 22 EM Nation ETFs that I observe on a weekly foundation and publish each third week. In celebration of Nationwide Andrews Pitchfork Week, each paid and free subscribers will obtain this week’s Rising Market’s Nation ETF Research despatched to their registered e-mail. This may enable free subscribers a onetime probability to see what they’re lacking out on by having the chance learn your entire content material. Previous publications will be accessed by paid subscribers by way of The Market’s Compass Substack Weblog. Subsequent week we will probably be publishing the The Market’s Compass US Index and Sector ETF Research.

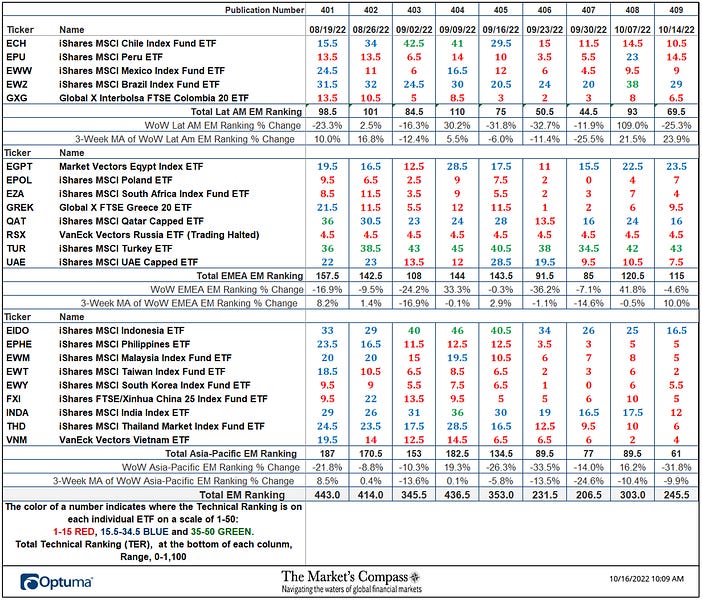

Final Week’s and eight Week Trailing Technical Rankings of the Particular person EM ETFs

The Excel spreadsheet beneath signifies the weekly change within the Technical Rating (“TR”) of every particular person ETF. The technical rating or scoring system is a completely quantitative method that makes use of a number of technical issues that embody however are usually not restricted to pattern, momentum, measurements of accumulation/distribution and relative power. If a person ETFs technical situation improves the Technical Rating TR rises and conversely if the technical situation continues to deteriorate the TR falls. The TR of every particular person ETF ranges from 0 to 50. The first take away from this unfold sheet must be the pattern of the person TRs both the continued enchancment or deterioration, in addition to a change in course. Secondarily, a really low rating can sign an oversold situation and conversely a continued very excessive quantity will be considered as an overbought situation, however with due warning, over bought situations can proceed at apace and overbought securities which have exhibited extraordinary momentum can simply turn into extra overbought. A sustained pattern change must unfold within the TR for it to be actionable. The TR of every particular person ETF in every of the three geographic areas also can reveal comparative relative power or weak point of the technical situation of the choose ETFs in the identical area.

The biggest achieve within the three EM Area Whole Rankings since we final revealed on September twenty sixth for the week ending September twenty third was within the Lat/AM area which rose +37.5% to 69.5 from the 50.5 studying registered 4 weeks in the past. That’s adopted by a barely lesser achieve of +25.7% within the EMEA Area Whole Technical Rating which rose to 115 from 91.5 over the identical interval. The Asia-Pacific area Whole Technical Rating registered a lack of -31.8% over the identical interval. Affected by a knock impact of the decline within the Whole Asia-Pacific Technical Rating the Whole EM Technical Rating rose solely +6.0% to 245.5 from 231.5 for the reason that final EM Nation ETF Weblog was revealed.

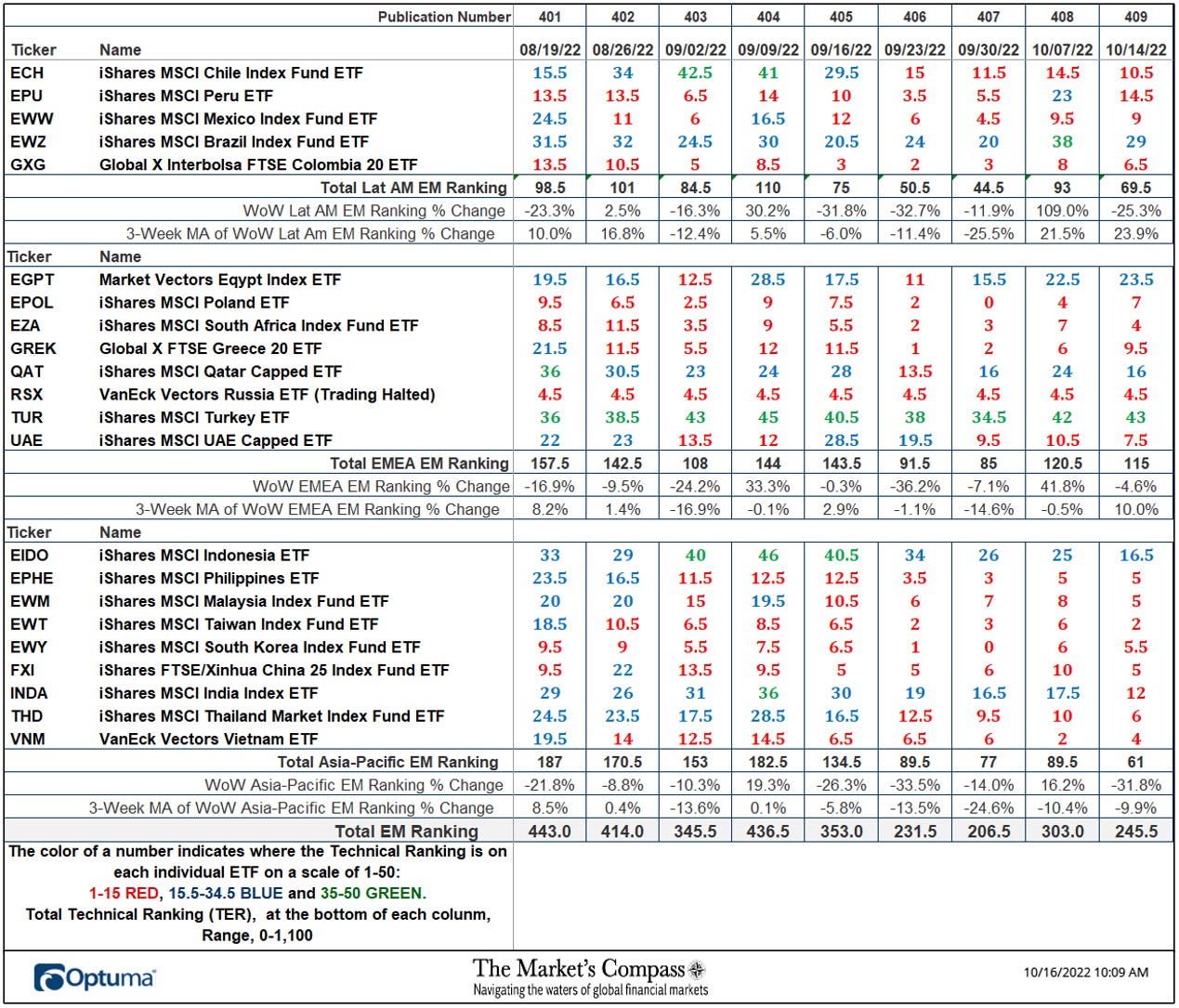

The Week Over Week Change in Particular person Technical Rankings

5 EM Nation ETF registered an enchancment in its particular person Technical Rating (“TR”) one was unchanged (excludes the VanEck Vectors Russia ETF (RSX) the place buying and selling has been halted for months) and fifteen noticed their TRs fall. The typical TR loss over the week was -2,61 “handles. The most effective TR achieve week over week was within the World X FTSE Greece 20 ETF (GREK) whose TR rose by 3.5 “handles” to 9.5 from 6. Though it rose by just one TR “deal with” I’ve chosen to focus on the iShares MSCI Turkey ETF (TUR) not solely as a result of it has the very best TR “rating” however due to it’s superior relative power as witnessed by the TUR / EEM relative ratio within the chart beneath. Readers will word that this can be a recurring theme that may current itself once more additional on on this weblog submit (see YTD relative efficiency).

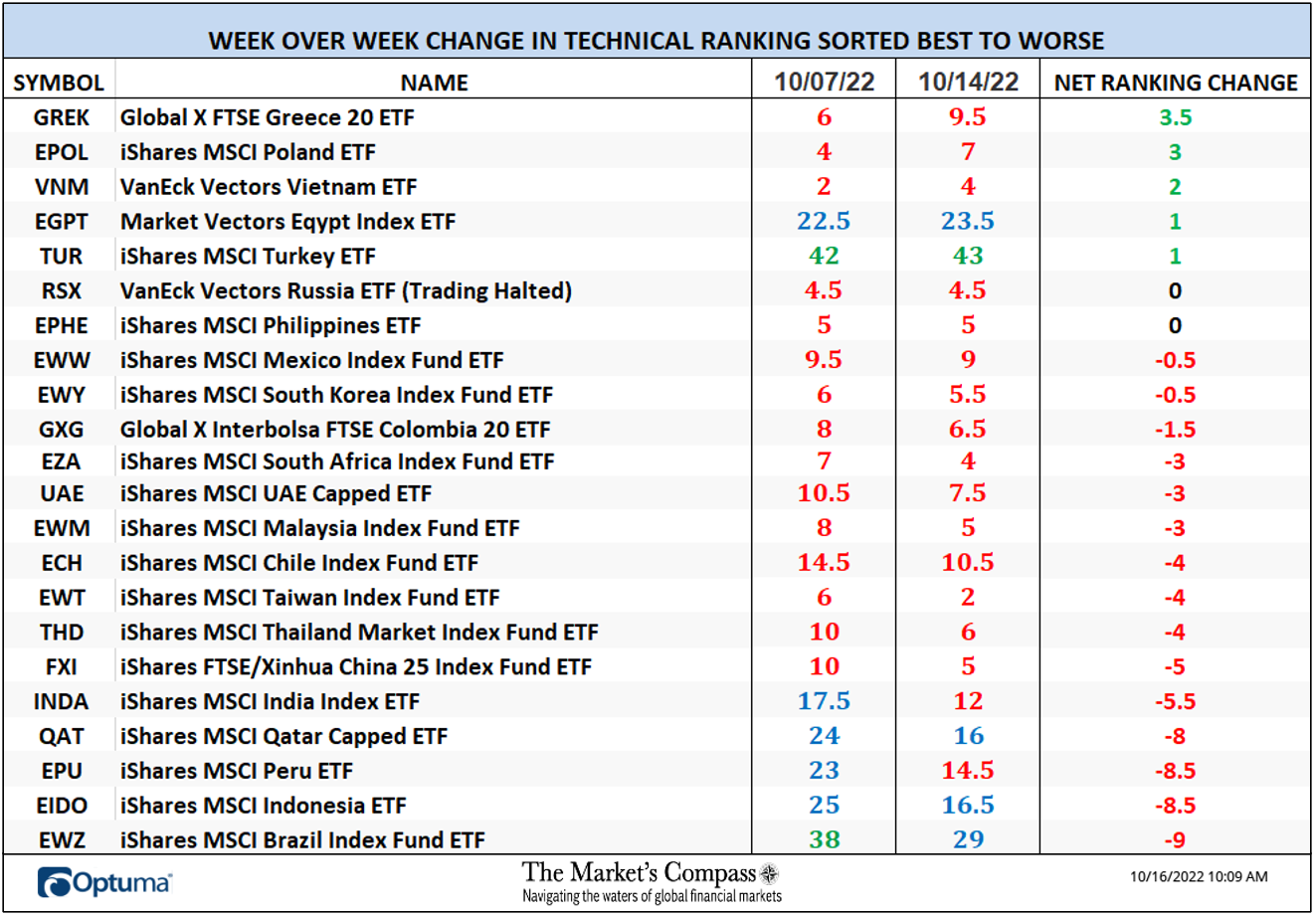

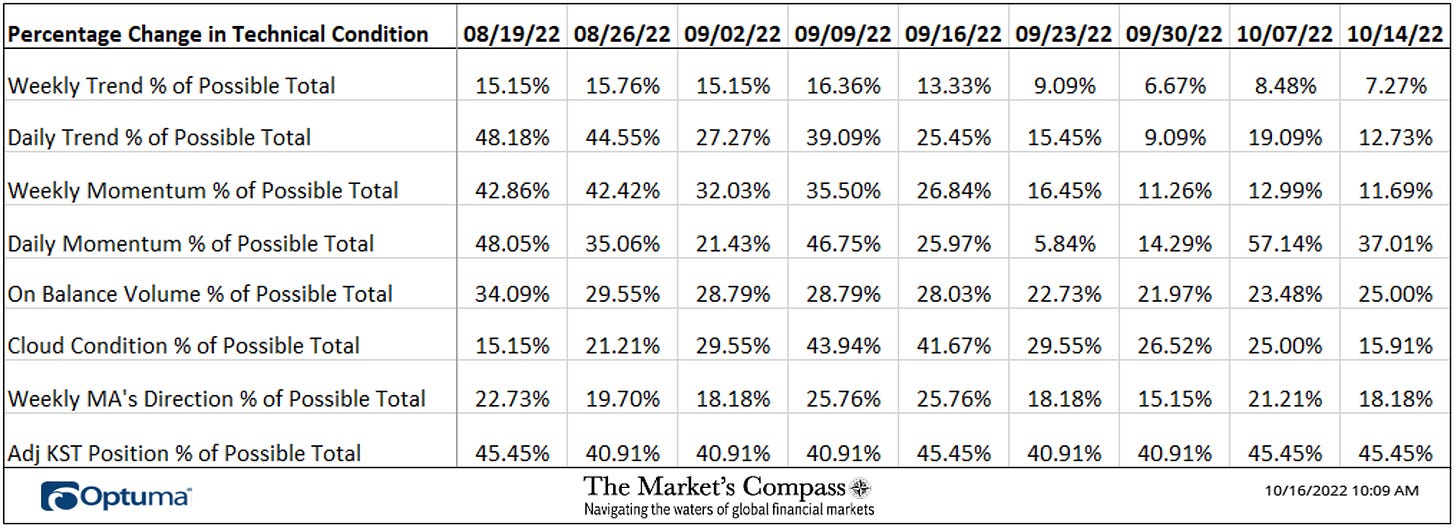

The Technical Situation Issue adjustments over the previous week and former 8 weeks

There are eight Technical Situation Components (“TCFs”) that decide particular person TR scores (0-50). Every of those 8, ask goal technical questions (see the spreadsheet posted above). If a technical query is optimistic an extra level is added to the person TR. Conversely if the technical query is unfavourable, it receives a “0”. A number of TCFs carry extra weight than the others such because the Weekly Development Issue and the Weekly Momentum Think about compiling every particular person TR of every of the 22 ETFs. Due to that, the excel sheet above calculates every issue’s weekly studying as a p.c of the potential whole. For instance, there are 7 issues (or questions) within the Day by day Momentum Technical Situation Issue (“DMTCF”) of the 22 ETFs (or 7 X 22) for a potential vary of 0-154 if all 22 ETFs had fulfilled the DMTCF standards the studying can be 154 or 100%. This previous week a 37.01% studying within the DMTCF was registered for the week ending September twenty third, or 57 of a potential whole of 154 optimistic factors. This was a drop from the week ending October seventh when the DMTCF marked a 57.14% studying. One technical take away can be if the DMTCF rises to an excessive between 85% and 100% it might counsel a short-term overbought situation was creating. Conversely a studying within the vary of 0% to fifteen% would counsel an oversold situation was creating. The week ending September twenty third the DMTCF was 5.84% suggesting a short-term oversold situation had developed. As a affirmation instrument, if all eight TCFs enhance on every week over week foundation, extra of the 22 ETFs are bettering internally on a technical foundation, confirming a broader market transfer greater (consider an advance/decline calculation). Final week six TCFs fell, one gained barely (On Stability Quantity TCF) and one was unchanged.

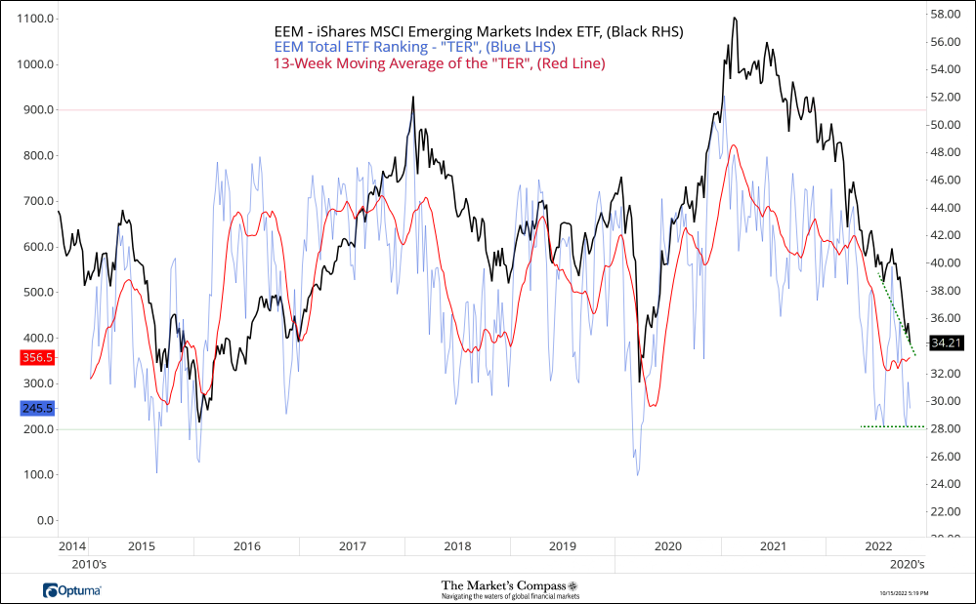

The EEM with the Whole ETF Rating “TER” Overlayed

The Whole ETF Rating (“TER”) Indicator is a complete of all 22 ETF rankings and will be checked out as a affirmation/divergence indicator in addition to an overbought oversold indicator. As a affirmation/divergence instrument: If the broader market as measured by the iShares MSCI Rising Markets Index ETF (EEM) continues to rally with out a commensurate transfer or greater transfer within the TER the continued rally within the EEM Index turns into more and more in jeopardy. Conversely, if the EEM continues to print decrease lows and there’s little change or a constructing enchancment within the TER a optimistic divergence is registered. That is, in a vogue, is sort of a conventional A/D Line. As an overbought/oversold indicator: The nearer the TER will get to the 1100 stage (all 22 ETFs having a TR of fifty) “issues can’t get a lot better technically” and a rising quantity particular person ETFs have turn into “stretched” the extra of an opportunity of a pullback within the EEM. On the flip aspect the nearer to an excessive low “issues can’t get a lot worse technically” and a rising variety of ETFs are “washed out technically”, a measurable low is near being in place and an oversold rally will doubtless observe. The 13-week exponential shifting common, in pink, smooths the unstable TER readings and analytically is a greater indicator of pattern.

The iShares MSCI Rising Market ETF (EEM) has fallen -4.92% over the previous two weeks and the TER has risen +6.0% to 245.5 from 231.5. Earlier than the TER bounce two weeks in the past the TER reached 206.5, matching the TER low registered on July fifteenth. To this point this has produced a brief time period divergence vs. the brand new bear market weekly closing low of 34.21 within the EEM on the finish of final week (inexperienced dashed strains).

It will be untimely to counsel that the optimistic divergence is a sign that the unrelenting promoting stress that has gripped the EEM has reached its terminus. That mentioned, it might not be a stretch to counsel that the EEM on the very least is due for at counter pattern worth transfer. A take a look at the short-term technical situation follows later on this weblog submit.

The Common “TR” Rating of the 22 ETFs

The Common Weekly Technical Rating (“ATR”) is the common Technical Rating (“TR”) of the 22 Rising Markets Nation ETFs we observe weekly and is plotted within the decrease panel on the Weekly Candle Chart of the EEM offered beneath. Just like the TER, it’s a affirmation/divergence or overbought/oversold indicator.

A second divergence in one other of my proprietary indicators versus worth has developed, this time it’s the EEM vs the ATR. The week ending September thirtieth the ATR registered a 9.39 studying matching the July fifteenth studying as costs continued to drop sharply to new lows (inexperienced dashed strains) however the shorter time period shifting common pink line continues to trace decrease beneath the longer-term exponential shifting common (blue line). One optimistic technical characteristic is that on Friday the EEM bounced off assist supplied by the Decrease Parallel (strong pink line) of the Schiff Modified Pitchfork (pink P1 by means of P3). Setting apart that brief time period optimistic technical characteristic, the largely unrelenting downtrend within the EEM since February of 2021 remains to be intact.

Ideas on the Quick-Time period Technical Situation of the EEM

Final Thursday the EEM opened sharply decrease originally of the buying and selling session however a worth reversal developed and the EEM closed up +0.29% on the day. That worth pivot gave start to the newly drawn Schiff Modified Pitchfork (inexperienced P1 by means of P3). On Friday an try and observe by means of to Thursday’s worth reversal failed and the EEM closed at a brand new bear market low.

A brief-term divergence has developed in my newly minted EM Nation ETF Day by day Momentum Oscillator as worth registered a decrease low and the oscillator has quickly held at the next low (inexperienced dashed strains). For that divergence to turn into certifiable I would wish to see costs to carry final Thursday’s low at 33.65 and ultimately the next excessive within the oscillator. That is doubtless an excessive amount of to perform within the short-term with out the EEM over taking Median Line resistance (inexperienced dotted line) and the Kijun Plot (strong inexperienced line).

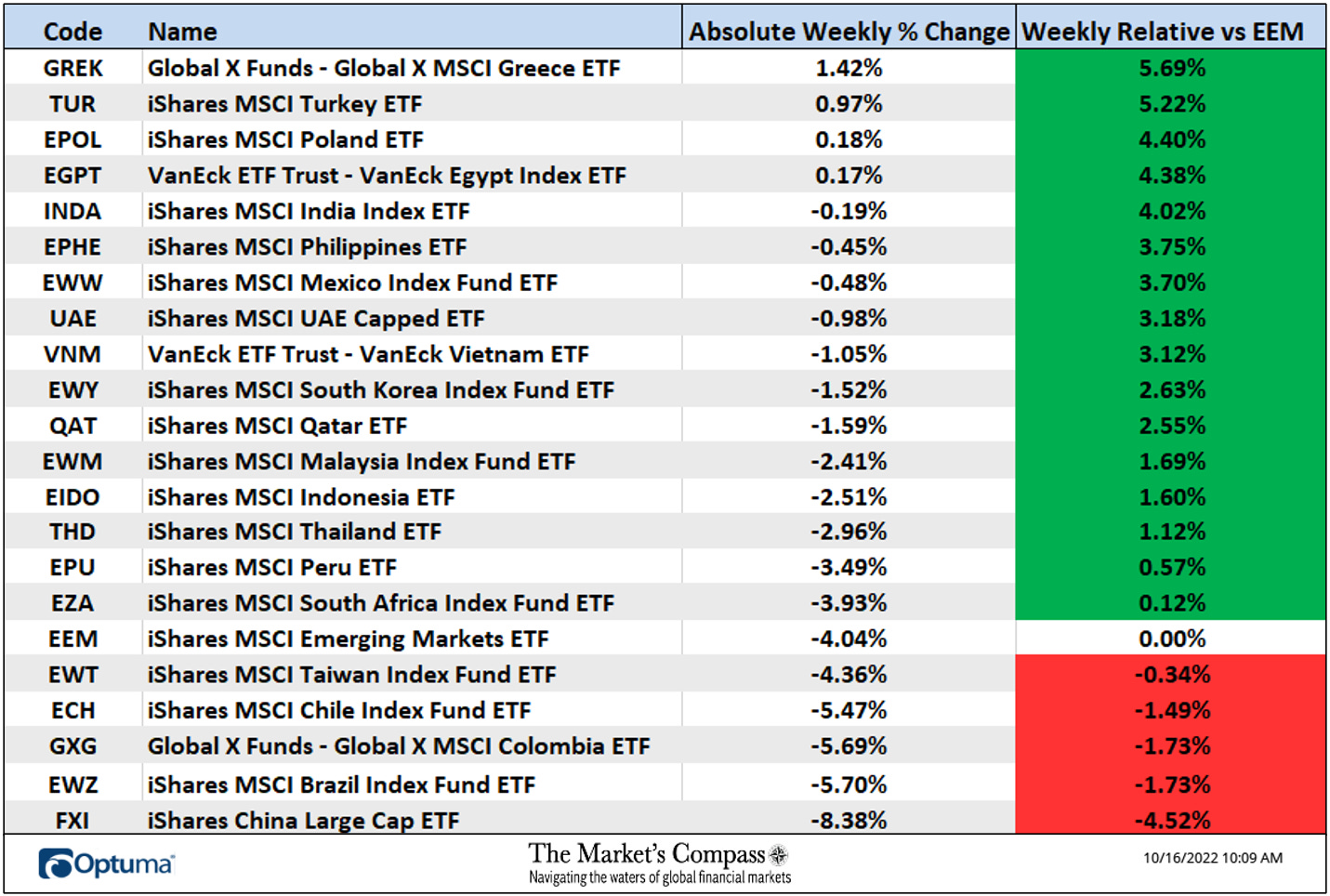

The Rising Markets Nation ETFs Weekly Absolute and Relative Value % Change*

*Doesn’t embody dividends, the VanEck Vectors Russia ETF (RSX) is once more, omitted.

Solely 4 EM Nation ETFs have been up on an absolute foundation final week. The highest two that improved have been the World X MSCI Greece ETF (GREK) up +1.42% adopted by the iShares MSCI Turkey ETF (TUR) up +0.97%. These wouldn’t usually be price highlighting if the common absolute lack of the 21 tracked ETFs wasn’t -2.38%. That mentioned, sixteen ETFs outpaced the EEM on a relative foundation and 5 underperformed. Of these 5, three have been Asia Pacific Nation ETFs, the biggest underperformer on a relative foundation over the previous 5 buying and selling periods (-4.52%) was the iShares China Giant Cap ETF (FXI).

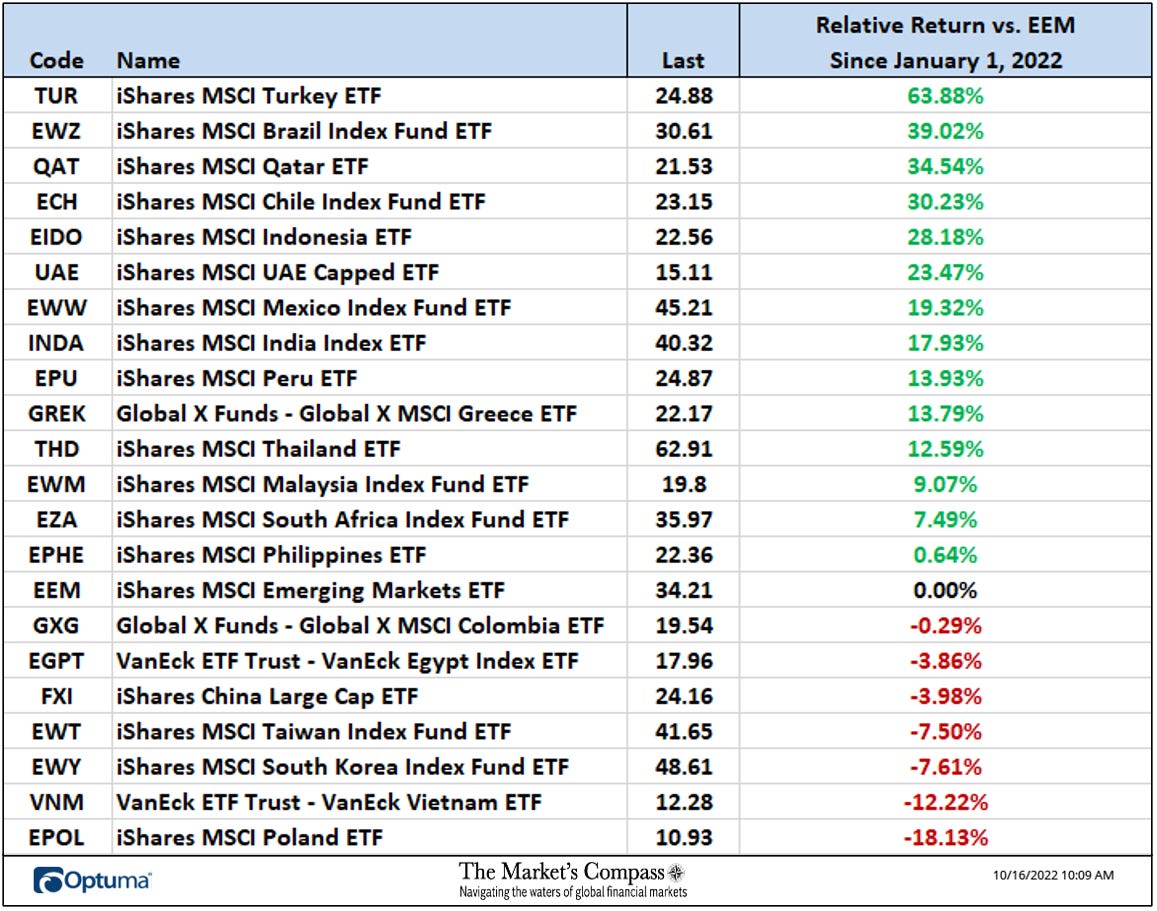

The Relative Return of the 22 EM ETFs Vs. the EEM Index 12 months to Date*

*Doesn’t embody dividends or the RSX

Charts are courtesy of Optuma, knowledge feed is courtesy of Bloomberg Finance L.P.

For readers who’re unfamiliar with the technical phrases or instruments referred to above can avail themselves to a quick tutorial titled, Instruments of Technical Evaluation or the Three-Half Pitchfork Papers on The Markets Compass web site…

https://themarketscompass.com