Bloomberg Intelligence’s senior macro strategist Mike McGlone is warning that Bitcoin (BTC) will seemingly face an enormous check within the second half (2H) of 2023.

McGlone tells his 58,800 Twitter followers that after a powerful efficiency within the first half of the 12 months (1H) Bitcoin will seemingly need to endure powerful recessionary circumstances through the subsequent six months.

The macro knowledgeable predicts that the inventory market will begin to decline and Bitcoin could have an opportunity to show itself as a retailer of worth, or “digital gold,” by not dipping together with equities.

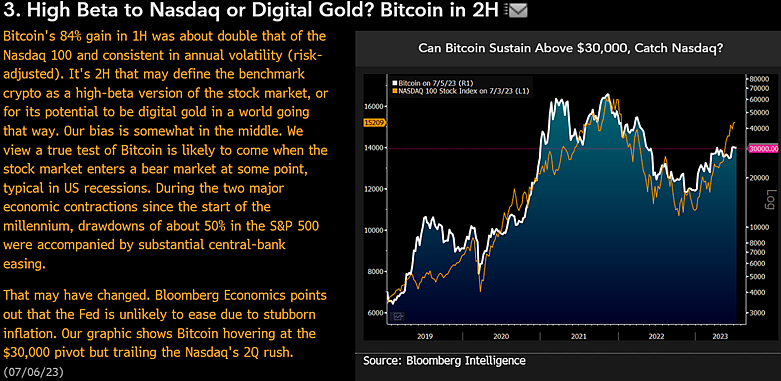

“Bitcoin’s 84% acquire in 1H was about double that of the Nasdaq 100 and constant in annual volatility (risk-adjusted). It’s 2H which will outline the benchmark crypto as a high-beta model of the inventory market, or for its potential to be digital gold in a world going that approach.

Our bias is considerably within the center. We view a real check of Bitcoin is prone to come when the inventory market enters a bear market in some unspecified time in the future, typical in US recessions.”

McGlone additionally warns that whereas in previous recessions the Federal Reserve was fast to ease financial coverage, the central financial institution could also be reluctant to take action this time round resulting from excessive inflation.

“In the course of the two main financial contractions because the begin of the millennium, drawdowns of about 50% within the S&P 500 have been accompanied by substantial central-bank easing. Which will have modified. Bloomberg Economics factors out that the Fed is unlikely to ease resulting from cussed inflation. Our graphic reveals Bitcoin hovering on the $30,000 pivot, however trailing the Nasdaq’s 2Q rush.”

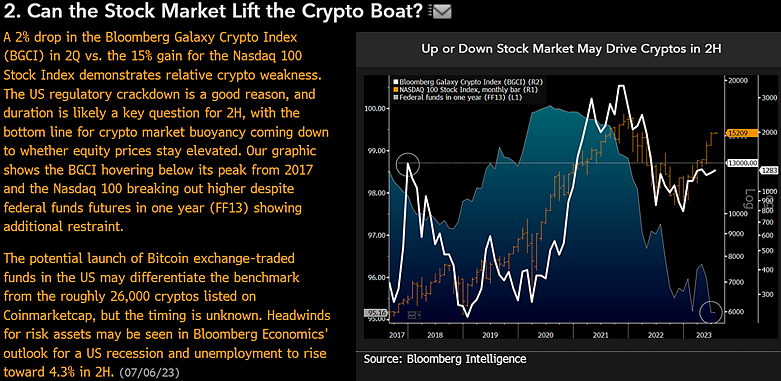

In line with McGlone, a weakening crypto market was already uncovered through the second quarter (2Q) of the 12 months as equities gained whereas prime digital property, that are tracked by the Bloomberg Galaxy Crypto Index (BGCI), declined.

“Midyear Outlook: Cryptos – The inventory market persevering with to publish good points could chip away on the basis for cryptos. That the Bloomberg Galaxy Crypto Index dropped in 2Q regardless of the sharp bounce within the Nasdaq 100 Inventory Index suggests divergent weak spot for the crypto market. A 2% drop within the Bloomberg Galaxy Crypto Index (BGCI) in 2Q vs. the 15% acquire for the Nasdaq 100 Inventory Index demonstrates relative crypto weak spot…

Our graphic reveals the BGCI hovering under its peak from 2017 and the Nasdaq 100 breaking out increased regardless of federal funds future in a single 12 months (FF13) displaying extra restraint.”

McGlone additionally says that headwinds are coming for danger property like Bitcoin as Bloomberg Economics predicts a recession within the second half of the 12 months with US unemployment hitting 4.3%, up from the present price of three.6%.

Bitcoin is buying and selling for $30,415 at time of writing, up 1.2% over the last seven days.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Examine Value Motion

Comply with us on Twitter, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl should not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any loses chances are you’ll incur are your duty. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please observe that The Day by day Hodl participates in affiliate internet marketing.

Featured Picture: Shutterstock/Kartavaya Olya/Konstantin Faraktinov