Throughout the week ending March 15, two Federal Reserve backstop amenities had been utilized by US banks to borrow a complete of $164.8 billion.

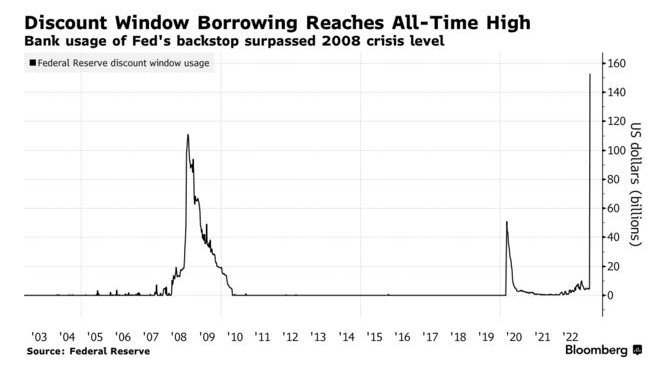

The standard liquidity backstop for banks, also called the low cost window, noticed a record-high borrowing of $152.85 billion, which elevated considerably from the earlier week’s $4.58 billion.

Based on a March 17 report in Bloomberg, this surpasses the all-time excessive of $111 billion reached throughout the 2008 monetary disaster.

Based on the info, the Financial institution Time period Funding Program, which is a brand new emergency backstop launched by the Consumed Sunday, recorded $11.9 billion in borrowing. The mixed credit score prolonged by means of each backstops highlights that the banking system remains to be weak and fighting deposit outflows ensuing from the latest collapses of Silicon Valley Financial institution of California and Signature Financial institution of New York.

Banking contagion

On March 16, the biggest banks within the nation reached an settlement to deposit roughly $30 billion with First Republic Financial institution as a part of an initiative led by the US authorities to stabilize the struggling California-based lender.

This after the choice final weekend by the US Treasury and the Federal Deposit Insurance coverage Corp. (FDIC) to safeguard all depositors of SVB and Signature, going past the standard deposit insurance coverage restrict of $250,000.

Nonetheless, Reuters reported that any financial institution bidding for Signature, one of many distressed banks that had a checking account belonging to Circle, could be compelled to surrender any crypto-related features of the enterprise.

Because it means for crypto, Circle, the founders of the second largest stablecoin market cap, USDC, the stablecoin was finally capable of get to its $1.00 peg, regardless of buying and selling to as little as .88 cents over the weekend.

Learn extra: Circle says considerably all USDC minting, redemption backlogs are resolved after wild week

“Belief, security, and 1:1 redeemability of all USDC in circulation is of paramount significance to Circle,” CEO Jeremey Allaire mentioned on a March 16 episode of the Bankless podcast.

“I’m a really deep believer in full-reserve banking,” Allaire added, the “concept that we don’t must have a fractional reserve, the place the bottom layer in authorities obligation cash, and the cost system innovation constructed on high is finished through the web utilizing software program.”