Cryptocurrency analyst and dealer Tone Vays is detailing the long-term bull case for Bitcoin (BTC) after the flagship digital asset reached two-year lows triggered by FTX founder and crypto outcast Sam Bankman-Fried.

In a brand new video, Vays tells his 123,000 YouTube subscribers that even when Bitcoin falls to round $11,000, the most important crypto asset by market cap may nonetheless attain a brand new all-time excessive of $100,000 subsequent yr.

The veteran crypto dealer believes that his predicted Bitcoin collapse will possible appeal to patrons who plan to carry BTC for the lengthy haul.

“We are able to have a capitulation all the way down to $11,000 and nonetheless hit $100,000 subsequent yr. As a result of a variety of Bitcoin is about to enter chilly storage as a result of folks should purchase it on a budget.”

Bitcoin is buying and selling at $16,886 at time of writing, up by about 8% from the two-year low of round $15,600 hit on Tuesday.

Vays says that if Bitcoin closes this week above the $18,500 assist stage, it could possibly be a sign that the flagship crypto asset has bottomed out.

“If we shut the week above this assist stage [$18,500], I’m going to be considerably assured that the low could be in. Proper now, it seems to be very, very promising.”

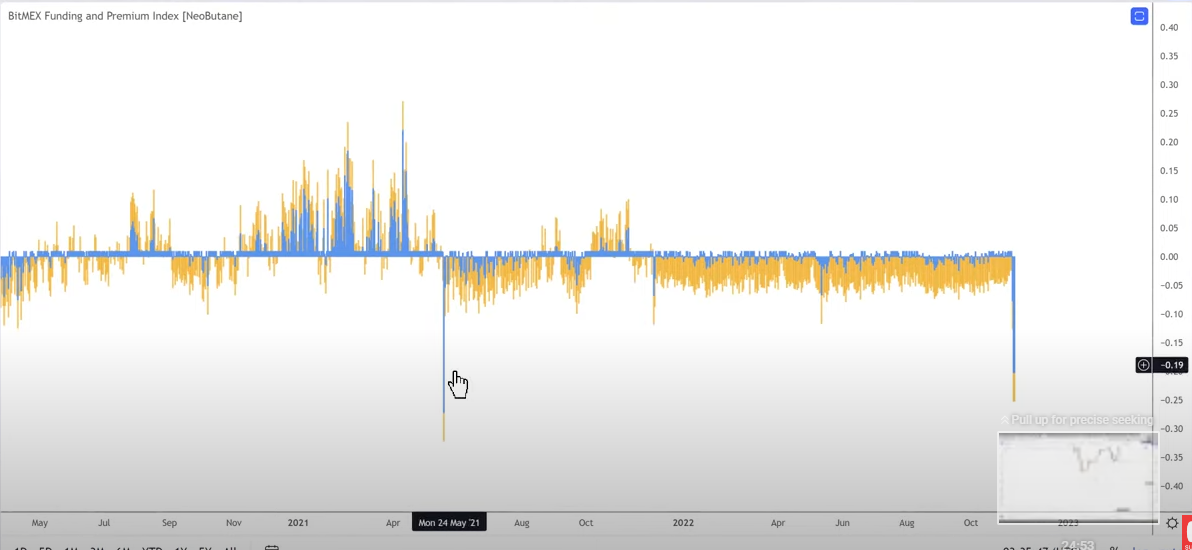

Based on the veteran dealer, the funding charges on crypto buying and selling platform BitMEX additionally point out {that a} backside could possibly be in for Bitcoin primarily based on historic habits.

“That’s how markets are likely to backside. Let’s have a look at the final time that BitMEX funding fee was this low. The final time the funding fee was this low was again in Might 2021. Let’s see what occurred in Might 2021. That was proper right here [$30,000]. Finally, off of that, we went to a brand new all-time excessive [of $69,000].

So I’ll take these odds. I’ll take the percentages that the low is in.”

Trying on the dealer’s chart, it seems that funding charges are extraordinarily damaging, indicating that merchants are closely accumulating quick positions. The situation may probably arrange the crypto marketplace for a brief squeeze, the place merchants who borrow models of an asset at a sure worth in hopes of promoting them for a lower cost to pocket the distinction are compelled to purchase belongings again because the commerce strikes towards their bias.

I

Do not Miss a Beat – Subscribe to get crypto electronic mail alerts delivered on to your inbox

Verify Worth Motion

Comply with us on Twitter, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl are usually not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal danger, and any loses you might incur are your duty. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please observe that The Each day Hodl participates in affiliate marketing online.

Generated Picture: DALLE-2