With over 280 centralized and decentralized exchanges within the crypto area, it’s more and more troublesome and time-consuming for customers to seek out the best choice for his or her digital asset swaps.

However what if there was a community constructed that will help you discover the best choice in your cryptocurrency swaps, together with the most cost effective transaction charges?

Enter 1inch Community, a decentralized alternate aggregator and liquidity supplier that shows the costs and liquidity accessible on a number of exchanges serving to you discover the most effective charges and lowest charges in your trades.

Be a part of us in our deep dive into 1inch DEX aggregator, an in depth breakdown of its expertise, historical past, benefits, and many others., and proceed with a fast tutorial that will help you get began.

What Is 1inch Community

1inch Community is a decentralized alternate (DEX) aggregator and automatic market maker (AMM) that goals to seek out essentially the most environment friendly swapping routes throughout main decentralized exchanges. It saves customers’ cash by discovering the quickest and least expensive route saved on the Ethereum blockchain and facilitated with out an middleman.

The platform divides the alternate amongst a number of alternate sources and checks for his or her market depths to make sure a consumer will get the most effective swap payment throughout many platforms. It shows the worth and liquidity accessible on a number of exchanges to confirm whether or not you’re getting the most effective fee.

At the moment, 1inch alternate sources liquidity over three blockchains: Ethereum, Binance Good Chain networks, and Polygon.

1inch community is developed by 1inch Labs, a decentralized staff of software program builders, and is ruled by the 1inch DAO. One other key contributor is the 1inch Basis, a non-profit group that has issued the 1INCH token and is liable for the community’s neighborhood initiatives.

Key Takeaways

- 1inch Community is a decentralized alternate (DEX) aggregator and automatic market maker (AMM) that shows the costs and liquidity accessible on a number of exchanges serving to you discover the most effective charges and lowest charges in your trades.

- The platform divides the alternate amongst a number of alternate sources and checks for his or her market depths to make sure you get the most effective swap payment throughout many platforms.

- Executing a digital asset swap on the 1inch App is simple, particularly utilizing the easy mode.

- 1inch Earn allows 1INCH token holders to earn passive earnings on their holdings via offering liquidity and staking.

How Does 1inch Work

So how does 1inch facilitate an asset swap? After submitting an order, 1inch will search throughout all appropriate sources and DEXs to allow cost-efficient and safe swap transactions throughout a number of liquidity sources.

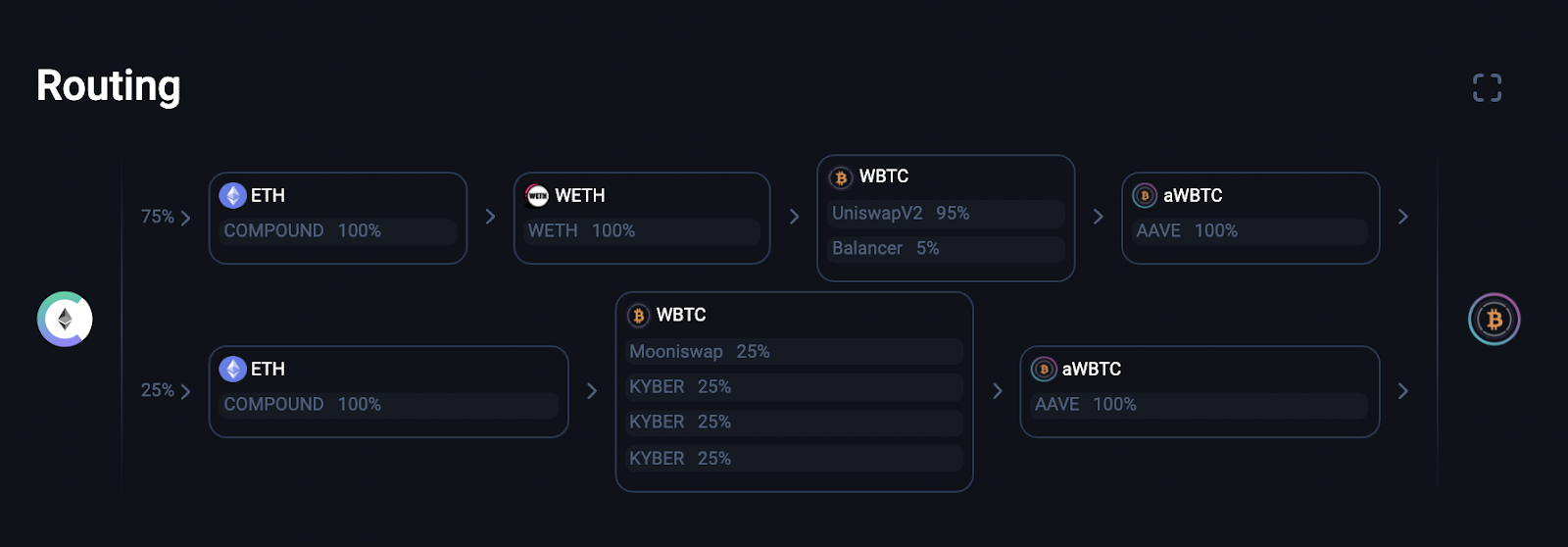

The protocol makes use of the Pathfinder algorithm to seek out the most effective buying and selling path throughout completely different markets with over 50+ liquidity sources on Ethereum, 20+ liquidity sources on Binance Good Chain, and seven+ on Polygon.

To realize this, the protocol depends on a number of protocols, which all work collectively to make sure a easy and environment friendly DeFi area. The three underlying protocols are:

Aggregation Protocol

The 1inch Aggregation Protocol’s key function is to supply liquidity from varied decentralized exchanges and liquidity protocols and break up a single commerce throughout a number of exchanges to supply the most effective charges. That is achieved by 1inch’s V3 good contract algorithm, which cross-references over 100 liquidity protocols to seek out essentially the most advantageous digital asset swap based mostly on parameters like value, liquidity, and slippage. The aggregation protocol makes use of the Pathfinder discovery and routing algorithm to seek out the most effective paths throughout a number of markets in lower than a second. It allows the protocol to separate a digital asset swap into quite a few transactions to supply customers the quickest swap with the bottom charges. It is a comparatively new function, launched as a part of the 1inch v2 upgrade.

Liquidity Protocol

Liquidity Protocol is an Automated Market Maker (AMM) that enables customers to commerce their belongings utilizing liquidity swimming pools mechanically. The liquidity protocol supplies liquidity to the swimming pools and allows customers to take part in liquidity mining applications to earn rewards.

The protocol works like different fashionable automated market makers, i.e., Uniswap and Sushiswap, mechanically facilitating purchase and promote orders on decentralized exchanges without having an order guide or central middleman. But, 1inch’s extra options assist it stands out from different AMMs.

The protocol’s good contract algorithms are liable for sourcing liquidity from completely different DEXs and swimming pools. The AMM protocol has entry to the deepest liquidity sources from the preferred networks, together with Ethereum, BNB Chain, Avalanche, Polygon, Optimistic Ethereum (oΞ), Gnosis Chain, Fantom, Arbitrum, Aurora, and Klaytn.

Restrict Order Protocol

1inch Community’s restrict order protocol allows customers to position restrict orders on their asset swaps through good contracts. The protocol facilitates versatile restrict order performance and options no charges. The protocol presents dynamic pricing based mostly on demand and provide, conditional execution of orders, multichain assist, and fulfills requests for quotations. Moreover, the protocol implements stop-loss orders, trailing cease orders, and auctions.

Quick Reality

1inch Community is totally non-custodial, that means that no central entity or third occasion ever controls consumer belongings. It is a nice promoting level for buyers because it nullifies the chance of asset freezing or censorship.

1INCH Token

1INCH is the protocol’s governance and utility token. It’s an ERC-20 token and is out there as a BEP-20 token on the BNB chain.

1INCH has a complete provide of 1.5 billion tokens, with a present circulating provide of over 584 million cash. On the time of writing, 1INCH is the 128th largest cryptocurrency, with a market capitalization of $359.2 million, in keeping with information from CoinStats.

The 1INCH token was launched on December 25, 2020. As a Christmas current, the token was airdropped to neighborhood members and customers, who beforehand executed no less than one commerce earlier than September 15, 2020, made no less than 4 trades in complete or traded a complete minimal quantity of $20. The token was additionally airdropped to 1inch liquidity suppliers.

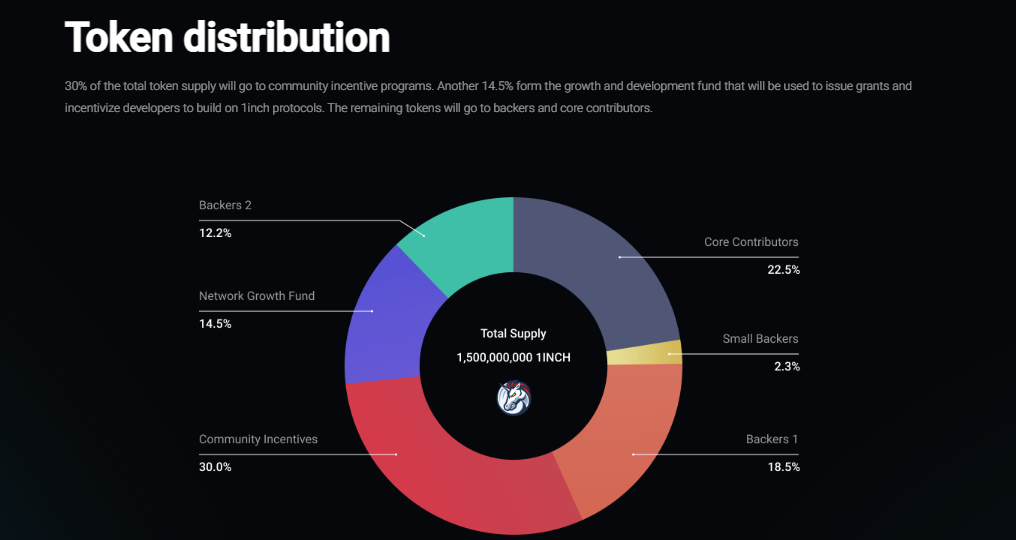

As per the official token launch announcement, the 1INCH token’s preliminary distribution was as follows:

- 56% of the entire token provide was allotted to core backers, contributors, and early buyers

- 30% was allotted to neighborhood incentives

- 14.5% – to the protocol development and improvement fund (with a 4-year unlock interval)

- 0.5% – to liquidity suppliers.

1inch Community Workforce and Historical past

1inch was launched in Could 2019 by Sergej Kunz, a former software program engineer at Porsche, and Anton Bukov, a former good contract developer on the Close to protocol. The protocol was launched in the course of the well-known ETHGlobal New York hackathon.

1inch community was initially launched with out enterprise capital companies or buyers’ funding.

Nonetheless, in August 2020, 1inch efficiently closed its first funding spherical led by Binance Labs, elevating $2.8 million from institutional buyers like Galaxy Digital, Greendiscipline One, Libertus Capital, Dragonfly Capital, FTX, and many others.

In December 2020, 1inch accomplished its second funding spherical led by Pantera Capital, elevating $12 million from outstanding institutional buyers like ParaFi Capital, LAUNCHub Ventures, and Nima Capital.

In December 2021, 1inch closed an astonishing $175 million Sequence B funding spherical led by Amber Group, with participation from the likes of Jane Road, VanEck, Fenbushi Capital, Alameda Analysis, Celsius, Nexo, and many others. This introduced the protocol’s complete valuation to $2.25 billion.

Learn how to Use 1inch Community

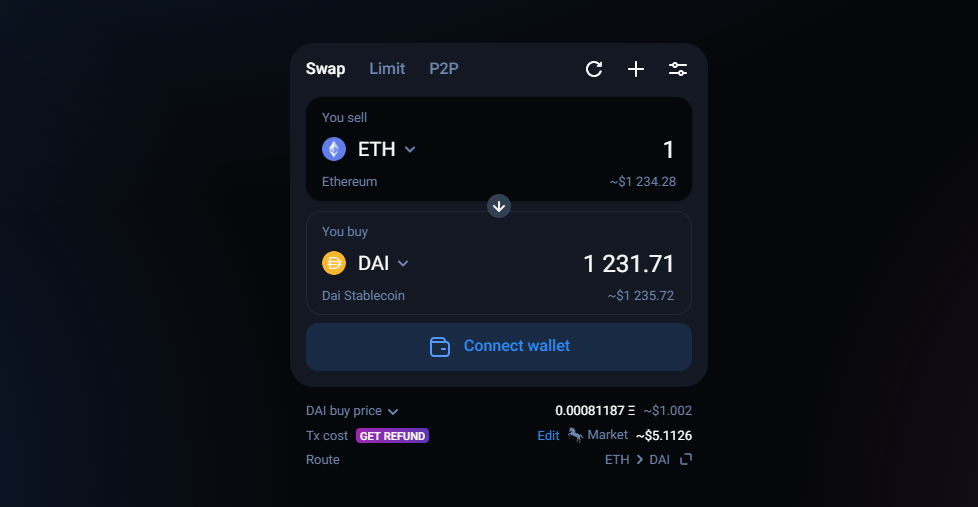

Executing a digital asset swap on the 1inch App is simple, particularly utilizing the easy mode. Right here’s the way it works:

- Open the 1inch App. The app will mechanically open the easy mode, which is extra user-friendly and presents fewer options.

- On the “Swap” window, click on “Join pockets.”

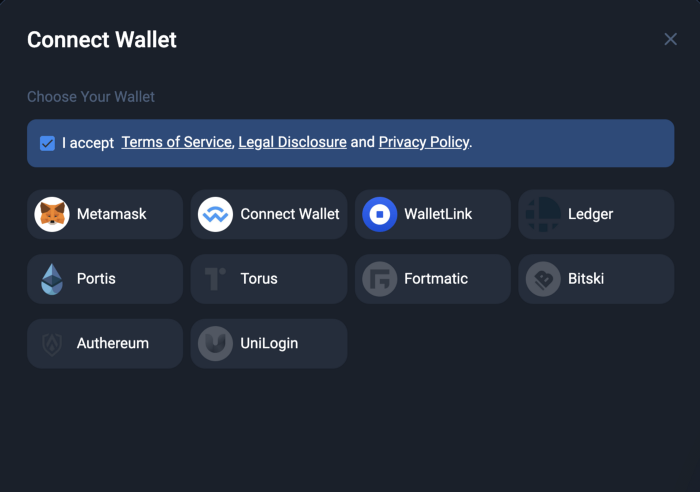

- This may immediate a window with all of the accessible wallets. Choose the one you’d like to make use of for the asset swap and settle for the phrases of service.

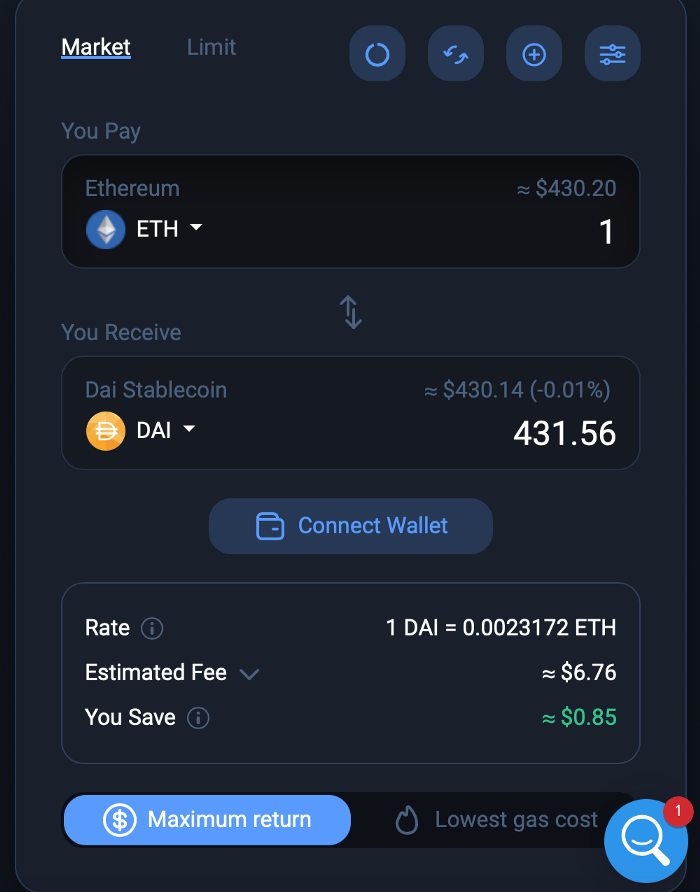

- When you’ve linked your crypto pockets, choose the cryptocurrency you need to promote and enter the quantity within the “You promote” tab. Then select the cryptocurrency you need to purchase in alternate by clicking on the “You purchase” tab.

- You too can select between “Most return,” i.e., the most effective swap charges, or “Lowest fuel price,” for the bottom transaction charges.

1inch DAO

The 1inch Community is ruled by the 1inch DAO — a decentralized autonomous group that permits 1INCH stakers to take part within the protocol’s governance by voting for key protocol parameters.

1inch Community DAO Treasury is a pool of funds beneath the possession of the neighborhood, managed by 12 multi-signature (multi-sig) wallets, of which 7 are wanted to signal transactions.

All protocol funds (just like the swap surplus created by Pathfinder) are directed towards the treasury, and not one of the income funds go to the 1inch Basis. The funds are used for grants and different network-oriented initiatives.

Professional-Tip

The app supplies a easy buying and selling mode for newbies and a traditional buying and selling mode with superior options for seasoned DeFi veterans. The community fees no buying and selling charges for asset swaps, and the protocol’s high stakers stand up to 95% refund for fuel charges charged utilizing the community.

Governance

The 1inch Community’s governance construction differs from most DeFi protocols with its immediate governance function, enabling the neighborhood to vote for protocol settings beneath the 1inch DAO in a clear, user-friendly, and environment friendly method.

On the spot governance has no entry boundaries for customers, making this governance construction extra decentralized and community-oriented.

1inch permits anybody holding the governance token to create proposals or vote on current ones. A consumer’s voting weight is straight proportional to the variety of tokens held within the staking contract. Customers can even select to delegate their voting energy to different addresses, often known as “Delegatees.”

Customers must stake their 1INCH tokens to be eligible to vote on the proposal and obtain extra tokens as staking rewards. The quantity of staking rewards is straight proportional to the charges generated on 1inch — extra protocol charges equal higher staking returns for voters.

In an effort in the direction of transparency, 1inch shows the high addresses by voting energy.

1inch Earn

1inch Earn allows 1INCH token holders to earn passive earnings on their holdings via the next strategies:

- Offering Liquidity

Offering liquidity is the primary option to generate passive earnings on the community. This includes locking a cryptocurrency buying and selling pair in 1inch’s liquidity swimming pools in alternate for an annual share yield (APY) starting from 1 to 205%, relying on the asset pair and buying and selling swimming pools.

Liquidity suppliers should stake each cryptocurrencies of the buying and selling pair in a 1:1 ratio, like LDO – stETH tokens.

- Staking

Staking is one other fashionable yield farming product on 1inch, which requires 1inch token holders to lock up their tokens for a set interval within the community’s staking contract.

Staking APY differs relying on the pool steadiness. On the time of writing, stakers earn a set 6.35% APR from the Turbo 1INCH staking pool.

Learn how to Stake on 1inch

- Go to the 1inch App homepage, click on the “DAO” part to open the drop-down menu, and click on “Staking.”

- On the Staking dashboard, click on “Join Pockets” within the higher proper nook and add the crypto pockets along with your 1INCH tokens.

- Enter the variety of tokens you want to stake within the “quantity” discipline, or conveniently choose the proportion of the entire holding you want to commit.

- When you’ve reviewed your choice, click on on “Submit.”

- After rigorously reviewing the transaction displayed in your crypto pockets, click on “give permission to stake 1INCH.”

- Approve the transaction and click on “Stake Token” on the Staking Dashboard. As soon as the transaction is executed, your tokens shall be staked on the 1inch good contract.

1inch Community Advantages

The advantage of utilizing 1inch is that the aggregation protocol presents the most effective swap charges throughout all DeFi protocols by selecting essentially the most environment friendly swap route from lots of of liquidity sources.

The community additionally presents a user-friendly front-end interface attracting crypto newbies and bolstering blockchain mass adoption. The app supplies a easy buying and selling mode for newbies and a traditional buying and selling mode with superior options for seasoned DeFi veterans.

One other main good thing about 1inch is that the community fees no buying and selling charges for asset swaps. Furthermore, the protocol’s high stakers stand up to 95% refund for fuel charges charged utilizing the community.

Safety is one other function that makes the community stand out amongst DeFi protocols. 1inch has a 91/100 Skynet Belief Rating, in keeping with blockchain safety agency CertiK. 1inch underwent quite a few safety audits from different industry-leading companies like SlowMist, OpenZeppelin, and Consensys Diligence, to call just a few. For every code vulnerability, 1inch performs an average of 16 audits, whereas different DeFi protocols request 3 to 4 audits for a similar points.

Get Impressed

1inch permits anybody holding the governance token to create proposals or vote on current ones. You too can select to delegate your voting energy to different addresses, often known as “Delegatees.”

You have to stake your 1inch tokens to be eligible to vote on the proposal and obtain extra tokens as staking rewards.

Final however not least, 1inch Community is totally non-custodial, that means that no central entity or third occasion ever controls consumer belongings. It is a nice promoting level for buyers because it nullifies the chance of asset freezing or censorship.

1inch Community Criticism

Whereas 1inch Community doesn’t elevate many issues, some individuals have questions regarding the 1INCH token. The explanation for concern is that 56% of the entire token provide was initially distributed to buyers and core contributors, which is an unusually massive share.

This raises issues concerning the token distribution’s centralization and potential value manipulation, because the group of stakeholders might create a major quantity of promote strain, leaving retail buyers holding the bag. It additionally is likely to be the doubtless motive why 1INCH is barely hanging within the high 130 tokens by market cap, regardless of the immense advantages of utilizing the community.

Backside line

1inch presents liquidity mining applications and compares alternate charges between a number of platforms to offer its customers with the very best choices. Furthermore, the alternate has an intuitive consumer interface and supplies an array of alternatives, equivalent to staking, supplying liquidity, incomes governance rewards, and many others.

At the moment, 1inch Community has a complete worth locked (TVL) of $2.3 million, down from its all-time excessive of $1.64 billion in March 2021. But, it’s price noting that this downtrend is correlated with the drastic TVL drop in DeFi, which noticed the {industry} fall from its peak of $216 billion in TVL in December 2021, all the way in which right down to $59 billion in TVL to its lowest in June 2022.

On the brilliant facet, 1inch Community will doubtless develop and recapture the misplaced TVL on account of its assist of the preferred blockchains and providing essentially the most worthwhile asset swaps within the {industry}. Moreover, 1inch Community is supported by a few of the most outstanding enterprise capital companies, serving to it to take care of its development by investing extra funding into the community to assist its improvement.