Are you able to consider a few methods you could possibly make the most of your crypto belongings? Lending and borrowing are most certainly nowhere close to your high mentions, proper? But, crypto loans are an ever-growing sensation within the nascent crypto business.

All the course of takes place seamlessly, because it makes use of good contracts to match lenders with debtors. For lenders, this could be a method to earn some passive earnings, whereas debtors can use their crypto with out cashing out.

Let’s discover how one of many largest lending platforms, Aave, works and enhance our information of crypto lending processes.

Key Takeaways

- Aave is an open-source liquidity platform that permits customers to lend or borrow cryptocurrency.

- The platform affords its customers three sorts of loans, particularly secure, variable, and flash loans.

- Aave is likely one of the largest DeFi protocols within the business, with a market cap of nicely over $1 billion.

- The native token of the platform is the AAVE token. The token is used to entry extra platform functionalities, in addition to for governance.

What Is Aave?

Aave is a decentralized lending protocol that permits its customers to borrow and lend varied cryptocurrencies with out the involvement of an middleman.

This merely implies that the transactions will not be ruled by any central authority. The transactions are, as a substitute, managed by good contracts. These good contracts are answerable for overseeing the distribution and allocation of crypto belongings. That is finished by means of a community of computer systems.

Why Was Aave Protocol Constructed?

The Aave system was initially constructed and primarily runs on the Ethereum blockchain, nevertheless it has additionally branched out to 6 different blockchains like Avalanche, Polygon, and Fantom. There are presently 35 completely different crypto cash obtainable for lending and 25 cryptocurrencies obtainable for borrowing, and completely different swimming pools include completely different pairs and rates of interest.

Aave was created to permit customers to both borrow or lend cryptos. Debtors are required to set down a certain quantity as collateral earlier than being allowed to borrow, whereas lenders can put their cryptocurrency to work and earn some returns.

Debtors

A consumer can set explicit crypto as collateral and borrow one other sort of crypto. For instance, a borrower could use BAT tokens as collateral and borrow ETH as a substitute. This provides customers publicity to a number of cryptocurrencies with out essentially proudly owning them.

Lenders

Lenders contribute cryptocurrency to the Aave market; this improves liquidity and makes funds obtainable to debtors. Customers that lend their funds to Aave earn passive earnings for offering liquidity. This earnings is given within the type of curiosity.

Aave protocol eliminates the necessity for any type of middlemen. All the pieces on the platform is run utilizing good contracts. Even the rates of interest are algorithmically calculated when a borrowing or lending transaction is carried out.

For debtors, the algorithm calculates the curiosity to be paid by evaluating the general obtainable funds to the funds wanted by the consumer. On the flip aspect, for lenders, the curiosity is calculated primarily based on the speed of incomes and withdrawal at any cut-off date.

Who Are the Founders of Aave?

Aave was initially launched in 2017 by Stani Kulechov in Switzerland. Kulechov constructed Aave whereas he was nonetheless a legislation pupil, receiving coaching on the College of Helsinki. His preliminary plan was to construct a protocol that allowed customers to borrow or lend crypto instantly. This was to be finished on this method; the lenders will put up mortgage affords whereas the debtors put up mortgage requests.

This protocol, referred to as ETHLend, was met with lots of difficulties. The foremost ones had been that ample liquidity wasn’t being supplied to the pool, and it was tough to match prepared lenders with prepared debtors. The bear market additionally took its toll. The mixture of those components led to its collapse in 2018.

Aave truly began out with the title ETHlend. Through the preliminary coin providing (ICO) in 2017, ETHlend raised a whopping 16.2 million {dollars}, however that was not all. The corporate additionally offered a billion models of its native token, LEND. The token is now often called the AAVE token.

After the collapse, the crew reviewed ETHlend in 2019 and adjusted from the peer-to-peer mannequin to the present peer-to-smart contract mannequin. Additionally they decided to vary the protocol title to Aave.

From ETHLend to Aave

On the time of the migration from LEND to AAVE, the tokens traded at a ratio of 100 LEND to 1 AAVE. This was finished in a bid to cut back the entire token provide. After the migration was finished, the entire provide was pegged at 18 million AAVE cryptocurrencies.

Aave was then formally launched in January 2020. Later within the 12 months, in August, the crew introduced a model 2 improve of the protocol.

Why Was Aave Created?

Aave was created to fulfill up the rising calls for for decentralized cash markets. Many customers required a technique of borrowing cryptocurrency while not having an middleman, which was why Aave got here to the rescue.

Aave customers now not have their sources managed by a centralized authority. They will now handle their funds and make transactions with them as they deem match. Customers don’t even should know the id of the individual they’re transacting with. Good contracts do all of the work right here.

So, anybody with a web3 pockets can comfortably carry out borrowing or lending transactions utilizing Aave.

Why Is Aave Common?

The recognition of Aave has grown because of fairly a lot of causes. The protocol has performed a key position within the decentralized finance business within the space of liquidity and expertise. It’s considered one of many topmost-ranked cash markets within the business. As a most up-to-date testomony to that, Aave has helped a standard finance large J.P. Morgan execute its first DeFi transaction.

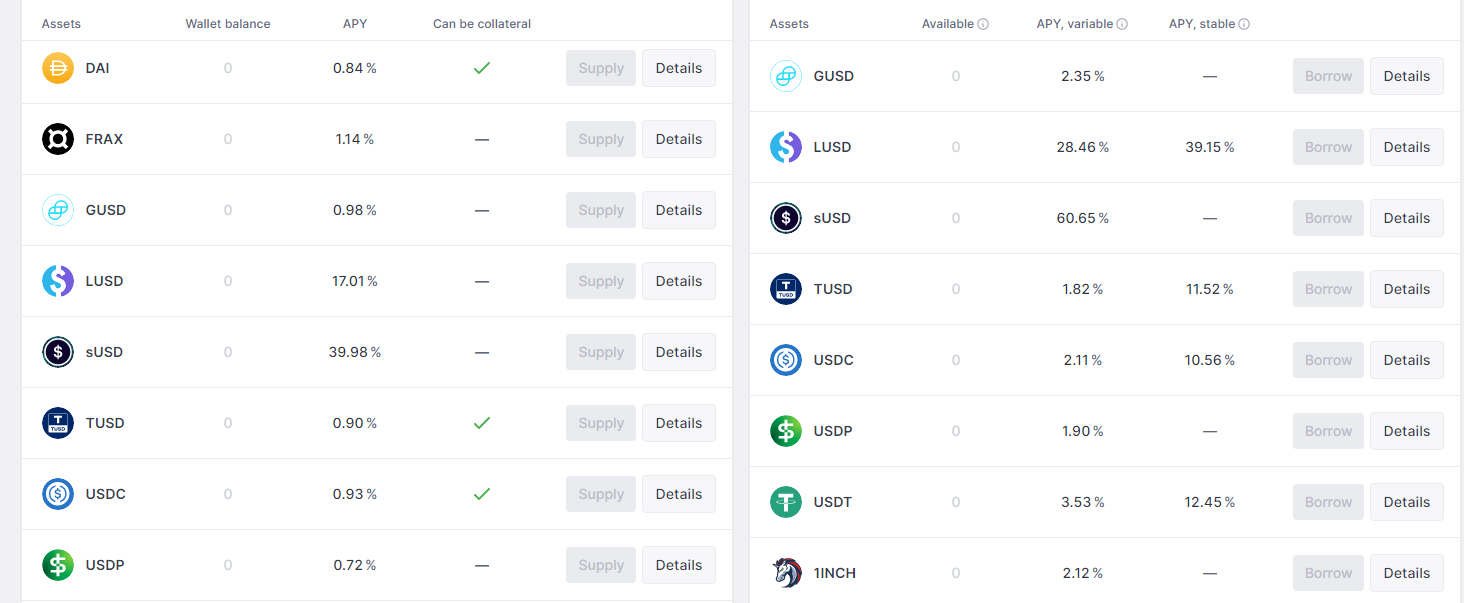

Aave makes use of Distributed Ledger Expertise (DLT) to log transactions. That is, nevertheless, not the principle distinguishing issue of Aave. The protocol permits customers to borrow or lend all kinds of crypto cash, together with extremely rated ones like Ethereum and USDT, in addition to different stablecoins and widespread altcoins.

The foremost cause behind the recognition of Aave is its distinctive “flash mortgage” function. This function permits customers to borrow cryptocurrencies while not having any collateral. The transaction should, nevertheless, be accomplished inside the time interval of a transaction block.

For flash Aave loans to work, the borrower should place a request, use it, and pay it again (plus a 0.09% payment), all inside the similar transaction block – in Ethereum’s case, 13 seconds. If the borrower fails to fulfill up, the transaction is routinely cancelled, and all traces are cleared off just like the transaction by no means occurred.

This ensures that each events (Aave and the borrower) encounter no danger.

Interoperability can also be an element that enhances the recognition of Aave. The decentralized lending protocol can interoperate with a wide range of decentralized finance platforms. This singular function makes it very priceless to customers who use Aave to carry out their lending and borrowing transactions.

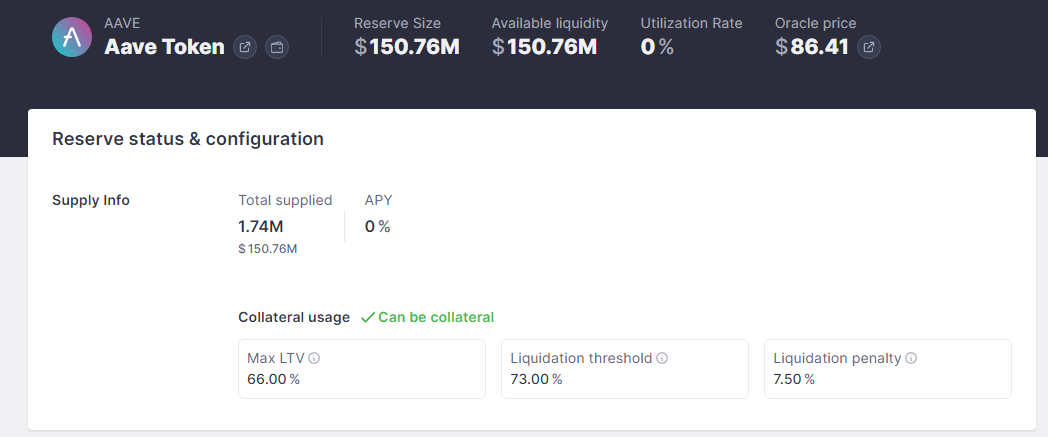

What Is Aave Token?

AAVE is the official governance token of the Aave protocol. Because of this AAVE token holders have the ability to determine what occurs on the community. Possession of the token provides a consumer the power to vote and determine the results of varied Aave Enchancment Proposals (AIPs) despatched throughout the community.

You need to observe that one AAVE token is the same as one vote. The extra tokens you might have, the extra votes you may solid.

Except for the AAVE token, one other token (or fairly a set of tokens) can also be used on the Aave protocol. These are the aTokens. aTokens are normally given to lenders who add to a pool. These tokens are issued to allow lenders to obtain their curiosity for offering liquidity to the pool.

Different advantages are additionally connected to the possession of AAVE tokens apart from voting. Debtors who deposit AAVE tokens as collateral normally get computerized reductions on transaction charges. Additionally, borrowing the AAVE token is normally freed from cost.

AAVE is a deflationary token. Because of this the token is burned always. Burning merely implies that a selected quantity of tokens are despatched to a pockets handle and not using a personal key to be locked away endlessly. This may cut back the variety of tokens in circulation and can, in flip, pressure their worth to go up.

About 80% of the transaction charges paid are used within the burning course of. About 3 million AAVE tokens have additionally been put aside by the event crew to foster the event and progress of the protocol. These cash are stored in Aave’s Ecosystem Reserve Contract.

AAVE token is presently one of many greatest DeFi tokens by way of market cap. You may commerce, trade, and purchase AAVE tokens on a number of respected crypto exchanges. You may retailer your AAVE on any Ethereum-supported blockchain pockets.

How Many AAVE Tokens Are in Circulation?

The utmost provide cap of AAVE is pegged at 16 million tokens. Nonetheless, out of this quantity, solely about 12.5 million cash are presently in circulation.

The vast majority of the quantity generated from the cost of transaction charges is used to purchase again the AAVE token, which might then be burned. This course of regulates the variety of tokens in circulation, and in addition contributes to the liquidity of the pool.

The market cap of the AAVE token is set by multiplying the circulating provide with the token’s market worth at any given time. The market rank of any coin is set by the market cap. The upper the worth of the market cap, the upper the rank of the crypto out there.

What Offers AAVE Tokens Worth?

The worth of AAVE is tied to its utility. The Aave protocol has lots of use instances and options that make it much more priceless. The worth of the token can also be tied to its provide, which is capped at a hard and fast worth of 16 million.

Aave’s DeFi protocol system makes use of 80% of the charges to buy AAVE tokens and burn them. This lowers the variety of tokens in circulation, which boosts the general worth of the token. The leftover 20% of transaction charges are used to provide incentives or rewards to those that lend funds to the liquidity pool.

The recognition and widespread acceptance additionally instantly have an effect on its worth. The extra individuals use the protocol, the upper its worth.

How Does Aave Work?

Aave capabilities as a decentralized cash market. Somewhat than connecting particular person lenders to debtors, Aave works utilizing liquidity swimming pools. Right here, lenders can add their crypto to the Aave swimming pools, after which they earn rewards primarily based on the quantity they deposited.

The swimming pools are algorithmically maintained, and the loans are additionally automated with none third-party interference. The loans typically are available varieties:

The loans are additionally obtainable in a number of completely different cryptocurrencies, together with BAT and LINK.

Every cryptocurrency has its distinctive borrowing price, all of that are listed on Aave’s official web site. Charges are calculated primarily based on the forces of provide and demand. If the demand is larger, the rate of interest is raised to encourage lenders to deposit extra of that crypto.

However, if the provision of explicit crypto is larger than its demand, rates of interest are lowered to encourage customers to borrow that crypto.

When performing any transaction on Aave, you get rewarded with aTokens, regardless of whether or not the deposited funds had been meant for lending or borrowing.

Every cryptocurrency has its personal aToken. As an illustration, a deposit of ETH will lead to aETH, whereas a deposit of BAT will give aBAT. These tokens are in equal ratio (1:1) with the worth of the asset in query.

These tokens could be saved in cryptocurrency wallets, exchanged, and even traded. This may give customers the chance to entry a variety of cryptocurrencies with out essentially proudly owning them.

As earlier acknowledged, debtors are required to deposit collateral earlier than being allowed to borrow. It ought to, nevertheless, be famous that the loans are overcollateralized. What this implies is that the collateral is predicted to be extra in worth than the quantity to be borrowed.

This Aave loaning system is an effective possibility for buyers who want liquidity however don’t wish to dump their crypto belongings outright. After being deposited, the collateral is handed over to the lender to maintain. And if the borrower can’t return the belongings inside the specified time interval, the lender retains the collateral.

Aave runs on a noncustodial system. This merely implies that the contributors to the liquidity pool don’t outrightly quit the possession of their digital belongings.

Volatility is an element that drastically impacts cryptocurrency belongings. Measures have been put in place to mitigate the results.

If the crypto’s worth will increase after depositing the collateral, the preliminary deposit can even improve in worth and will likely be collected by the borrower after repaying the mortgage.

If the worth decreases beneath 82.5%, the deposit is misplaced to the protocol and given to the lender.

Reserves

The crypto market could be extraordinarily risky, and excessive market swings can flip a enterprise like Aave down the drain. To keep away from this, Aave has reserved funds for liquidity swimming pools. This fund is price 3 million AAVE tokens and acts as a buffer for lenders.

Oracles

Aave will also be used to establish the real-time worth of collateralized belongings. In collaboration with Chainlink, Aave acts as an oracle to speak with completely different blockchains.

Flash Loans

The crypto lending scene modified when Aave launched flash loans. These are loans that have to be repaid inside one block and can be utilized to leverage discrepancies in crypto costs throughout completely different exchanges.

Curiosity Fee Switching

Moreover, customers get the choice to vary their rate of interest construction. Aave lets you choose both fixed or fluctuating charges everytime you like. Frequently altering charges are decided by the liquidity pool’s demand. In distinction, secure charges are primarily based on an merchandise’s common rate of interest over the earlier 30 days.

Aave Execs and Cons

As with each different DeFi protocol, Aave has its execs and cons.

Aave Execs

Robust institutional backing

Aave is backed by many credible crypto establishments. Winklevoss Capital and DTC capital are two widespread ones. With this sturdy backing, it’s simpler to belief the Aave developmental crew within the time of an improve.

Multi-faceted makes use of

To the pure thoughts, Aave is used to get loans, however having flash loans is greater than a evident benefit. Flash loans are completely different from regular loans as a result of the loans have to be repaid in a single block and will help improve beneficial properties by means of scalping little discrepancy in crypto costs.

Aave Cons

Over-collateralization

Aave’s enterprise mannequin requires the over-collateralization of loans. Though it protects the system, this mannequin means common customers can’t take loans past what they already personal.

Low-interest charges

Aave affords low-interest charges. Whereas this may appeal to debtors, the core of the system, Lenders, may favor competitors with larger charges.

Is Aave Secure?

The Aave protocol is extremely secured. It periodically goes by means of periodic audits to make sure its good contract is uncompromised, and lenders and debtors can seamlessly use the platform for his or her lending and borrowing actions. Loans are virtually all the time overcollateralized to keep away from a case the place the Aave platform doesn’t have sufficient liquidity. This makes the platform proceed operating even within the probably occasion of mortgage default. One other method Aave all the time ensures optimistic liquidation is thru a collateral threshold. That is related as a result of the good contract routinely places loans in liquidation as soon as they fall beneath this restrict.

The platform additionally makes use of reserve liquidity swimming pools that make use of these funds to fend off market turbulence. The reserves moreover act as safety for lenders whose cash will likely be accessible after they wish to withdraw it from the liquidity swimming pools.

Backside Line

Lending and borrowing are two ‘crypto languages’ that won’t be going out of vogue within the cryptocurrency market. Like within the conventional market, merchants will all the time have a necessity for loans, both to leverage arbitrage alternatives or to get different issues with out liquidating their crypto holdings. Aave has positioned itself strategically by means of oracles, flash loans, and its interest-bearing tokens, and it’s fascinating to see how issues play out after this present crypto bear market.